York’s Mitrefinch secures £20m investment from LDC to drive international growth

Mitrefinch, the York-based developer of human capital management (HCM) software, has secured an equity investment of more than £20m from LDC to support its international expansion.

The investment, part of a management buyout led by CEO Debbie Guppy, will see LDC become a significant shareholder in the company, alongside additional members of the management team.

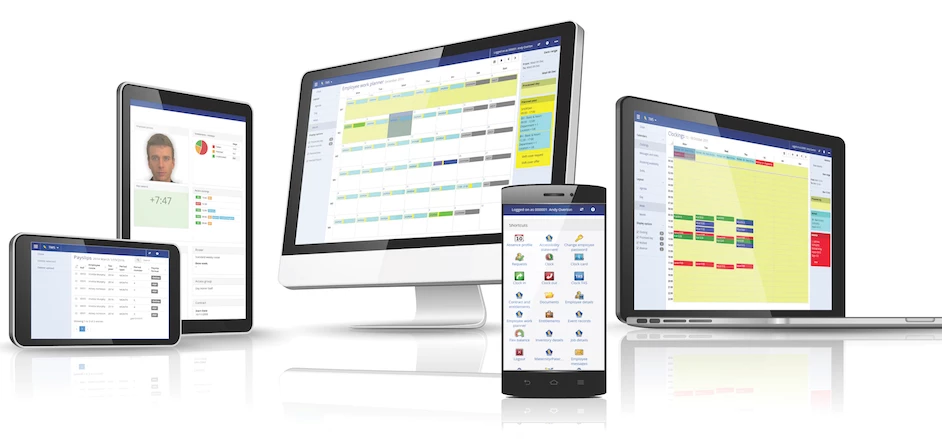

Mitrefinch provides an integrated suite of HCM software spanning time and attendance, rostering, HR and payroll.

Customers include small and medium sized firms (SMEs), mid and large corporates, public bodies, charities and universities, with brands such as L’Oreal, Nestle, Amec Foster Wheeler, DFS, the Forestry Commission and the University of Leicester.

Human capital management software is a $1.8bn global market that is estimated to be growing at more than 10% per annum.

Mitrefinch’s revenues have grown 50% over the last three years from £10m to £15m.

Following LDC’s investment, the company plans to expand its nascent overseas business in Canada, the US and Australia.

Mitrefinch is also set to significantly invest in new product development to continue expanding and improving its suite of products, including its software as a service (SaaS) offering and its rostering product suite.

Debbie Guppy, CEO of Mitrefinch, said: “This is an important step for the business and an exciting time for our people and customers. From the outset, LDC saw the potential in the business and bought into our vision as a management team.

“Their approach, track record and sector expertise gave us the confidence they were the right long-term investment partner to help us deliver our ambition for the business - to be the leading provider of integrated, SaaS-based human capital management software in the market with a growing and global customer base.”

Jane Gilbert Boot, an investor in LDC’s Leeds office, added: “Debbie and the team have built an enviable market position for Mitrefinch, with a high-performing suite of integrated products and a loyal, fast-growing customer base.

“With significant additional capital to invest in the business, a high quality team and a clear growth strategy, it has a real opportunity to achieve a dominant position in a growing, consolidating and globalising marketplace.”

John Garner, director and head of LDC in Yorkshire and the North East, added: “Backing Mitrefinch is another signal of our appetite to invest from the regions to support ambitious UK businesses and their management teams. There are dozens more firms across the region with that same potential to scale, and it’s important management teams know there are experienced partners like LDC who stand ready to support them.”

The business was advised by GCA Altium’s Manchester office in a process led by Adrian Reed, Dom Orsini and Jon Stead, with legal support from Squire Patton Boggs (Steven Glover).

LDC was advised on its investment by KPMG (Jonathan Boyers, Alex Hartley, Graham Pearce and Nick Dodd from KPMG’s Deal Advisory practice), DLA (James Kerrigan and Chris Wilson) in Manchester and Harris Williams.

Debt facilities were provided by Silicon Valley Bank (Emma Stephens and Darren Davidson).

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular Yorkshire & The Humber morning email for free.

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses