Partner Article

Only FCA-accredited P2P short term lender launches to provide alternative to payday lenders

One of the new breed of FinTech platforms to launch from the Financial Conduct Authority’s (FCA) Project Innovate incubator programme has launched today to give those looking for short-term finance an alternative to payday lenders.

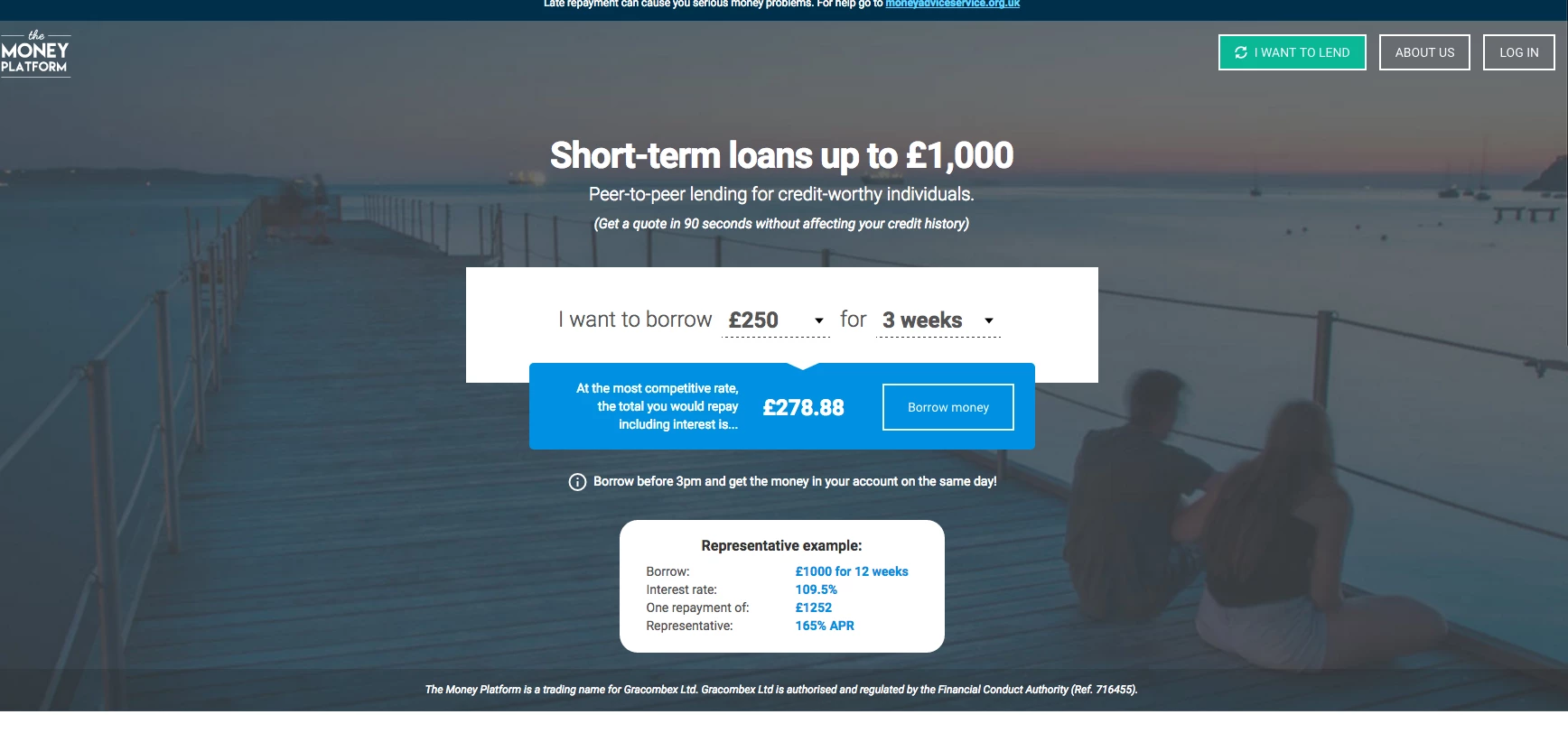

The Money Platform is a peer to peer (P2P) short-term lender that is looking to give workers an alternative to expensive overdraft fees and increasingly maligned payday lenders.

It launches following a two month soft launch, after working its way through the FCA’s incubator programme, which launched last year to help commercialise the latest financial technology innovations.

Through its platform, the startup operates in much the same way as other P2P lenders, putting borrowers directly in touch with lenders to provide short term finance up to a maximum of £1,000 at rates of around 0.3% and 0.7% per day.

Where it differs from other payday lenders is that it only lends to what it deems ‘creditworthy individuals in employment’ who have the ability to pay the loan back in full within three months, thus reducing the chances of borrowers falling into disastrous spirals of debt.

Its technology is powered by its credit decision engine, which the firm claims only approves finance from those with strong credit ratings, an element which has played in part in making it the only FCA-accredited short-term lender.

Charles Balcombe, Co-Founder of The Money Platform, said: “Historically the short term loan market has been viewed as ‘morally bankrupt’ – and with good reason. With two years in planning, we are finally delighted to present British consumers with an affordable short term loan option and to shake up this industry through transparency and ethical practices.”

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning London email for free.

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses

A year of growth, collaboration and impact

A year of growth, collaboration and impact

2000 reasons for North East business positivity

2000 reasons for North East business positivity

How to make your growth strategy deliver in 2026

How to make your growth strategy deliver in 2026

Powering a new wave of regional screen indies

Powering a new wave of regional screen indies