Partner Article

The former chief of Uber Italy is launching her machine learning-powered savings app in the UK

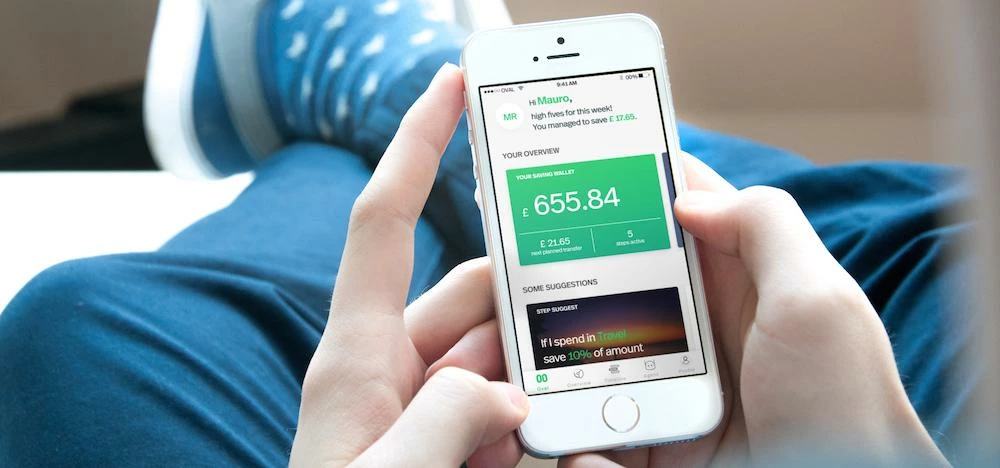

Oval Money, the app which utilises machine learning to help users grow their savings pot, has launched in the UK today helmed by the former Chief Executive Officer at Uber Italy.

The FinTech firm, which has grown from its Italian base, attempts to encourage behavioural change through a combination of automatic savings driven by its machine learning technology and crowdsourced advice which the startup claims will help people better monitor their spending habits.

Drawing on the latest research from financial experts and behavioural economists, the app’s approach is defined by its ‘Steps’, commands which a user can set up so that various actions in one account can automatically put money aside depending on the users preferences.

These include rounding up transactions and placing the difference in a savings account (similar to the approach utilised by London-based investment app Moneybox), a percentage saving that puts aside an amount equal to a fixed percentage of a specific income or transaction, and a set amount which is put aside each time the user makes a specific transaction.

Founded by Benedetta Arese Lucini, Oval’s senior management team also includes Claudio Bedino and Edoardo Benedetto, who previously founded crowdfunding platform Starteed, and Chief Technology Officer Simone Marzola, who brings with him expertise in machine learning and artificial intelligence.

According to the company, its combination of a technological solution along with its active community which is encouraged to advise others on how to turn its ‘Steps’ to their advantage have seen beta users save on average around £135 per month.

Following its launch, Lucini commented: “We are really excited about the level of community engagement we have seen among our beta users. When it comes to personal finance, it is clear that people want to help each other make better decisions.

“This not only involves the gratification of telling others that you are getting your finances on track, but also in knowing that there is a support network you can both contribute to and learn from. This is what being an Ovaler is all about.”

Currently Oval’s UK presence extends to one employee in London, its Marketing Manager Viviana Verin, but there are plans afoot to grow headcount in the capital once the app takes off, with Lucini also spending around half her time in London.

The company recently closed its €1.2m Seed funding round which included participation from Italy’s Gruppo Intesa SanPaolo, b-ventures, an incubator from Japan’s DOCOMO Digital, and Bertoldi Group Family Office.

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning London email for free.

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses

A year of growth, collaboration and impact

A year of growth, collaboration and impact

2000 reasons for North East business positivity

2000 reasons for North East business positivity

How to make your growth strategy deliver in 2026

How to make your growth strategy deliver in 2026

Powering a new wave of regional screen indies

Powering a new wave of regional screen indies

A new year and a new outlook for property scene

A new year and a new outlook for property scene