Partner Article

Working in the Dark Ages: Fifth of Accountants Still Using 13th Century Methods

A new report has found that despite six in ten (61%) accountants saying that the finance and accounting profession is at a technological tipping point, six in ten (64%) still know someone who is using old methods such as paper ledgers and desktop spreadsheets as their primary accounting tools.

The research from cloud accounting software company Xero finds there is a high expectation that accountants should be up-to-date with the latest accounting technology, with only a small number (6%) of SMB owners citing that it’s not important. Despite this, eight in ten (78%) accountants who work in accounting and bookkeeping firms still work off computer spreadsheets and a fifth (18%) still use a paper ledger, used as far back as the 13th century, to manage accounts.

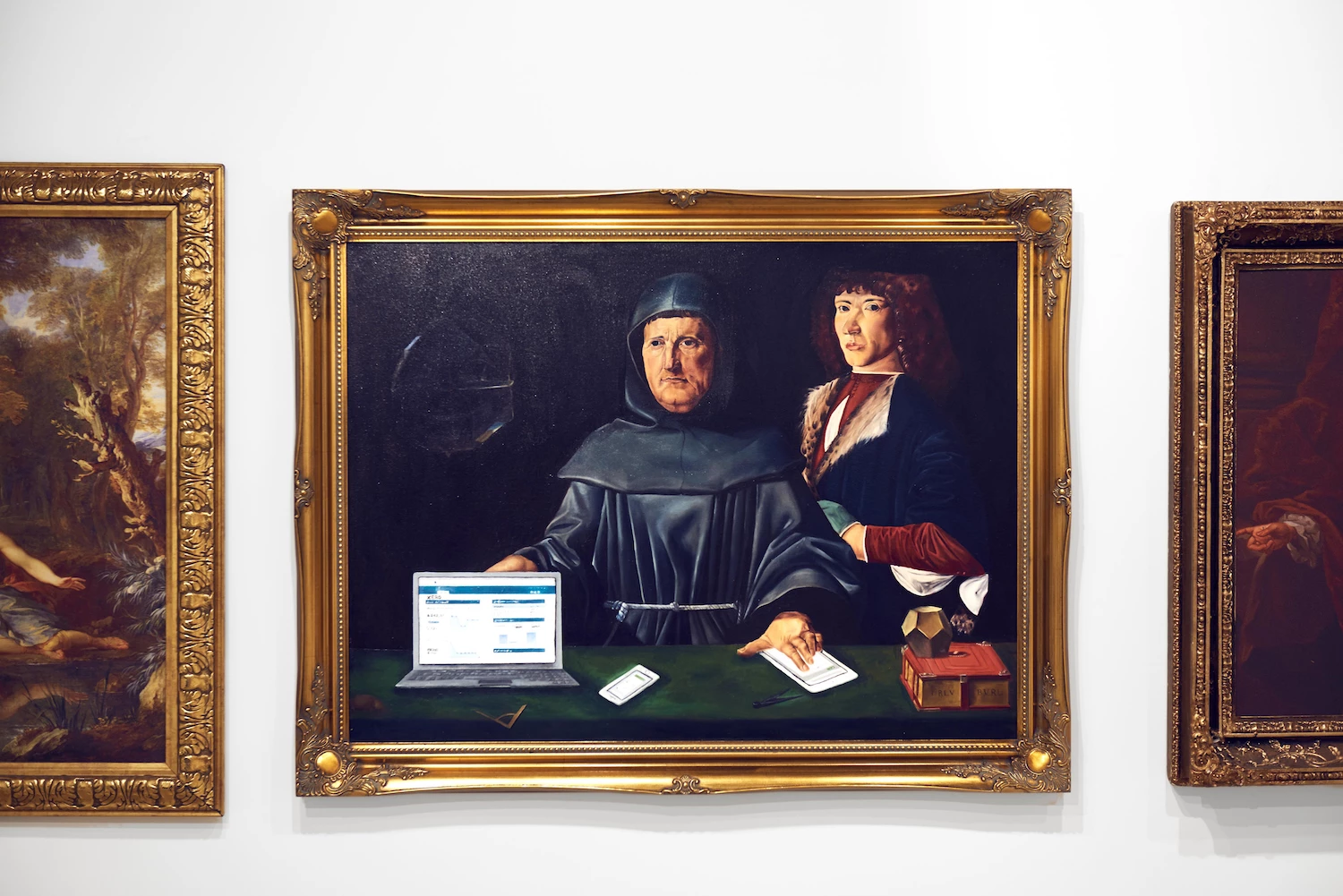

To encourage accountants and small businesses to ‘keep up’ and get their accounting systems online, Xero has launched its Digital or Die report and commissioned renowned renaissance artist China Jordan to recreate the Portrait of Luca Pacioli; the man known as the ‘Father of Accounting and Bookkeeping’. The update brings Pacioli, who was the first to publish a detailed description of the double entry system, into the modern age by updating his ledger with modern-day technology.

The Digital or Die report finds half (48%) are worried about the speed of change impacting the accounting industry and being left behind – rising from 22 per cent in 2016. This is amplified by the fact that more than a third (35%) do not think there is enough education or training available to ensure that UK accountants will be able to keep up with the pace of digital change and upcoming legislation.

With change on the horizon, only 17 per cent of accountants say they are very prepared for upcoming legislation, such as Making Tax Digital, the government’s plan to make tax returns digital and quarterly. A further quarter (25%) of accountants were not aware of Making Tax Digital at all – a concern, as a quarter of SMB owners (25%) believe that it’s their accountant’s responsibility to keep them updated with the latest legislation.

Damon Anderson, Director of Partner at Xero, comments: “Over the next few years, small businesses and their accountants will need to embrace digital or run the risk of quickly being extinct. Our report shows that one in ten small business owners and a fifth of accountants in firms still use paper ledgers - a tool that dates back to the year 1299 - with many losing hours to menial administrative tasks. It’s time to work smarter.

“The UK accounting industry is entering a new digital age, driven by unprecedented changes in accounting technology and a perfect storm of regulation from MTD, PSD2 to GDPR. We want to encourage practices to take the first step in ensuring they remain relevant by embracing the latest technology.”

Shaun Robertson, Director, Qualifications from The Institute of Chartered Accountants in England and Wales (ICAEW) adds: “Some accountancy professionals fear being ‘left behind’ by the speed of change, which is why it’s so important to learn about the benefits, opportunities and challenges of new technologies. In some cases, technology such as AI may supersede human efforts, however, it does not replicate human skills and intelligence. We need to recognise the strengths and limitations of different forms of technology, and build better understanding of the best ways for humans to benefit from computers.”

When asked about the perceived benefits of going online, Xero’s Digital or Die Report finds:

- Cloud based accounting could save accountants 117.5 hours a year on average (15 days) by eliminating the time spent on administrative tasks – approximately £3,153.70 per year, per staff member.

- A quarter (23%) say it could save them more than half a day per week (4 hours).

This was posted in Bdaily's Members' News section by Xero .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning National email for free.

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses