Partner Article

Students compete for big money in first pension portfolio challenge

This weekend, twenty-five student teams from around the world will participate in the final round of the McGill International Portfolio Challenge, the world’s first pension asset allocation competition.

The teams will travel to McGill’s Desautels Faculty of Management to compete for a first-place cash prize of C$25,000, and additional cash prizes of C$25,000 to be shared amongst other finalist teams – making this one of the largest total cash prizes for any business-school competition in the world.

The student teams – from Berkeley, Chicago, Sydney, Hong Kong, and Geneva, amongst others – have been working to come up with innovative ways to address the challenge of underfunded pensions.

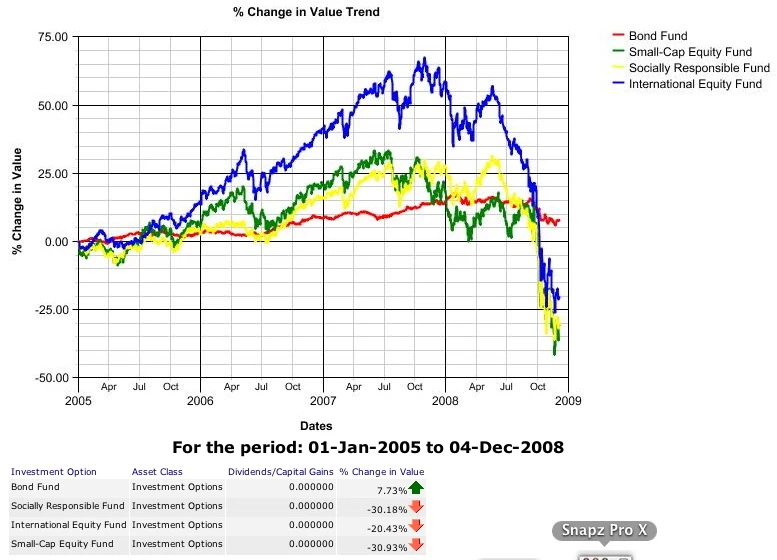

The teams will address the fictional case of a severely underfunded defined-benefit pension fund in a mid-sized Canadian forestry company. They have been tasked with reviewing the asset allocation of the fund and looking for innovative ways to invest the assets while satisfying all the stakeholders involved.

They will pitch their solutions to a panel of judges from some of the world’s largest asset management firms; including Canada Pension Plan Investment Board, CIBC Asset Management, PWL Capital, Caisse de dépôt et placement du Québec, PSP Investments, Ontario Teachers’ Pension Plan, BlackRock and Mercer.

Sebastien Betermier, Associate Professor of Finance at McGill’s Desautels Faculty of Management, predicts that the top proposals will be an eye-opener, even for experienced industry judges: “The student teams have put a tremendous amount of thought into this and they come at it with a fresh perspective; some of their ideas may not have occurred to asset managers who have been grappling with this challenge for years.”

This was posted in Bdaily's Members' News section by Desautels Faculty of Management at McGill University .

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses