Partner Article

Continued growth for UK construction despite dip in project starts

Glenigan’s July Construction Review shows industry recovery maintains momentum, despite supply shortages setback.

- Main contracts awards rise 12% in Q.2, up 82% on last year and 9% in 2019

- Value of project-starts decrease 17% against past three months

- Retail is the best performing sector for project-starts, increasing by 61% on the three months prior, up 186% on 2020 levels

- Volume of work carried out on-site slips 0.8% in May possibly due to supply shortages but output remains 40% higher than 2020

- Planning consent approvals drop by 14% compared to first quarter, down 9% on last year

Today, Glenigan, the construction industry’s leading insight and intelligence experts, releases the July edition of its Construction Review.

This monthly report provides a detailed and comprehensive analysis of construction data, giving built environment professionals unique insight into results from the second quarter of 2021.

Continued optimism

There are reasons to maintain an optimistic perspective, as the industry continues to show increased growth against 2020.

A rise in main contract awards points to a strong pipeline of projects, increasing 12% against the first quarter of 2021, up 82% on last year and 9% on levels in 2019.

However, a slight 0.8% dip in the volume of work carried out on-site during May, and a 17% decrease in the value of project starts in Q.1, indicates momentum is moderating following a burst of activity in Q.1, in part exacerbated by supply-side shortage.

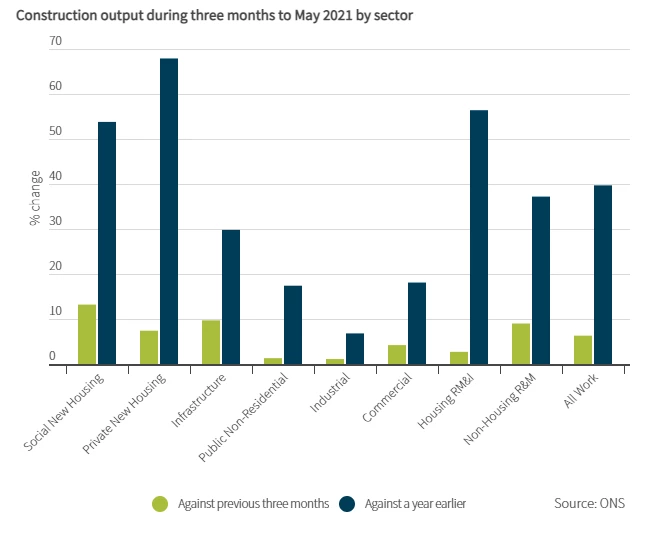

However, against the context of a 6.3% increase in output during the three months to May, this demonstrates industry resilience, particularly when we see it against a 39.7% increase a year ago.

Major projects are currently averaging £1,773 million per month, rising 14% against the previous three-month figures. This was also 66% higher than lockdown levels and up 32% on figures from 2019.

Retail and offices drive sector growth

A project-starts boost is also anticipated over the next few months, particularly in the retail and office sector

As the best performing sector for underlying starts (less than £100million in value) in July’s Review, the retail sector has seen underlying project starts (less than £100 million in value) increase by 61% on the previous three months, up 186% on 2020 levels and 41% higher than 2019 figures.

Office starts also rose by a third compared to Q.1 figures and are up 87% on the previous year. However, they remain 9% lower than the same time period in 2019.

Infrastructure and housebuilding remain robust

Infrastructure has been the best performing overall new work sector, increasing by 10% against the three months prior.

Further, private housing output has risen by 7% and new social housing by 13%. Overall, the level of new build output has risen 6.6%, and has now increased by over a third on 2020 figures.

There’s also been slight growth for the industrial sector, edging 1% higher whilst the commercial sector grew by 4%.

Supply shortages continues to stunt activity

The volume of work carried out on-site slipped 0.8% during May, however, due to a strong start in March, output was 6.3% higher than the three months previous.

This could be a result of construction supply shortages, causing delays to work. However, output still remains around 40% higher than in 2020 when the first national lockdown caused substantial disruption.

Repair and maintenance work also grew by 6%, 36% ahead of figures a year ago. This could be in anticipation of recent changes introduced by the Building Safety Bill which will tighten the regulatory framework within the housebuilding sector.

Planning permission remains sticking point

Planning permission approval remains a challenge across the industry, with figures 14% lower than Q1, representing a 9% decrease on last year.

This drop was mainly due to a fall in the value of major projects securing planning approval, 51% lower than last year and declining 33% against first quarter figures. Commenting on these findings, Glenigan’s Economic Director, Allan Wilen said: “Whilst the increase in contracts awarded shows an industry in ascendancy, we are observing momentum beginning to moderate following a burst of activity in the first half of the year. This is reflected by a slight dip in the volume of work and new projects starts. It’s likely that construction supply shortages have also been a disrupter.

“Overall, we’re seeing direct improvement across many different areas of the sector when compared to 2020. This should fill construction professionals with hope for continued progress in the coming months.”

This was posted in Bdaily's Members' News section by Dale Maycock .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning National email for free.

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses