London credit card startup raises £20m to disrupt the payments industry

A London-based credit card startup has raised £20m in a seed round ahead of its UK launch to disrupt the payments industry.

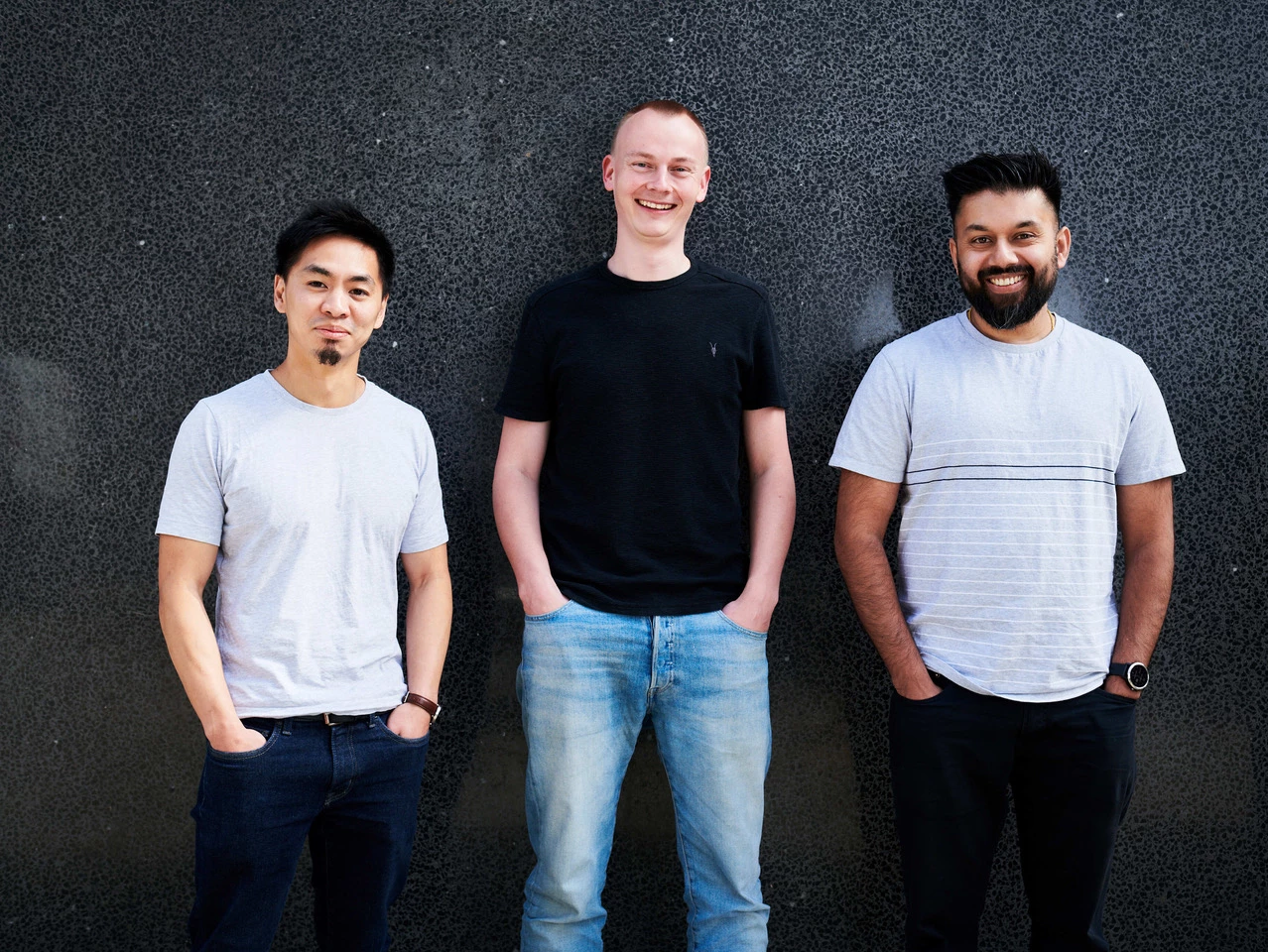

Credit card challenger, Yonder, was founded in 2021, as a solution for expats who might have a stable income and a mortgage in their home country, but are unable to find an appealing credit provider in the UK.

The round was co-led by Northzone and LocalGlobe, with Seedcamp participating alongside a host of angels, including former England footballer, Rio Ferdinand.

Yonder’s mission is to restore consumers’ confidence in credit, eliminating stress and complexity from the customer experience. The fintech offers a rewards programme designed around customers’ lifestyles. Yonder’s credit card will provide members with access to exclusive drinking, dining and leisure experiences with partners including The Gladwin Brothers and Kricket restaurants, plus the ability to spend abroad with zero FX fees.

Tim Chong, CEO and co-founder, Yonder, said: “For too long, credit cards have taken advantage of consumers. Hidden fees, discriminatory credit scoring, and rewards that belong in the 1990s, all in the interest of bank’s quarterly earnings.

“The new funds will enable us to grow our team and build an incredible selection of rewards and features. We’re thrilled to have the backing of investors with such a strong track record in propelling consumer fintechs to success.”

Jeppe Zink, general partner at Northzone commented: “Yonder is creating a modern, digital credit card experience for young professionals that replaces outdated loyalty programmes with a highly curated experience-based membership service. There is an urgent need to redesign the payments industry with the customer at the heart – and Yonder is doing exactly that.”

Remus Brett, general partner at LocalGlobe added: “Credit has earned a bad rap, with companies benefiting from a huge profit pool while sidelining their customers’ best interests. We’ve been actively looking to invest in credit challengers, and Yonder has all the qualities we look for at LocalGlobe.”

Carlos Espinal, managing partner at Seedcamp said: “We backed the team at Yonder because they have a vision for how credit products need to evolve from where they are today, catering to the few and well established, rather than enabling a new generation of customer to live life and experience the best of what their local community has to offer.”

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning London email for free.

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses