Talion secures funding to grow mid-market reach

A Leeds-based cyber security specialist is scaling its operations following a £2 million investment.

Talion Cyber Security has secured funding from existing investors including NPIF - Mercia Equity Finance, managed by Mercia and part of the Northern Powerhouse Investment Fund, as well as the Crown Fund S.C.A. SICAV-RAIF.

Originally formed within BAE Systems in 2010 to protect the 2012 London Olympics, Talion became independent in 2020 through a management buy-out.

Today, it competes with major managed security service providers and offers a broad portfolio including managed detection and response, threat intelligence, penetration testing and incident response.

Bosses say the investment will “accelerate” Talion’s growth and extend its reach across the UK and US, giving more mid-market organisations access to advanced cyber protection in a sector facing rising threats but often overlooked by major providers.

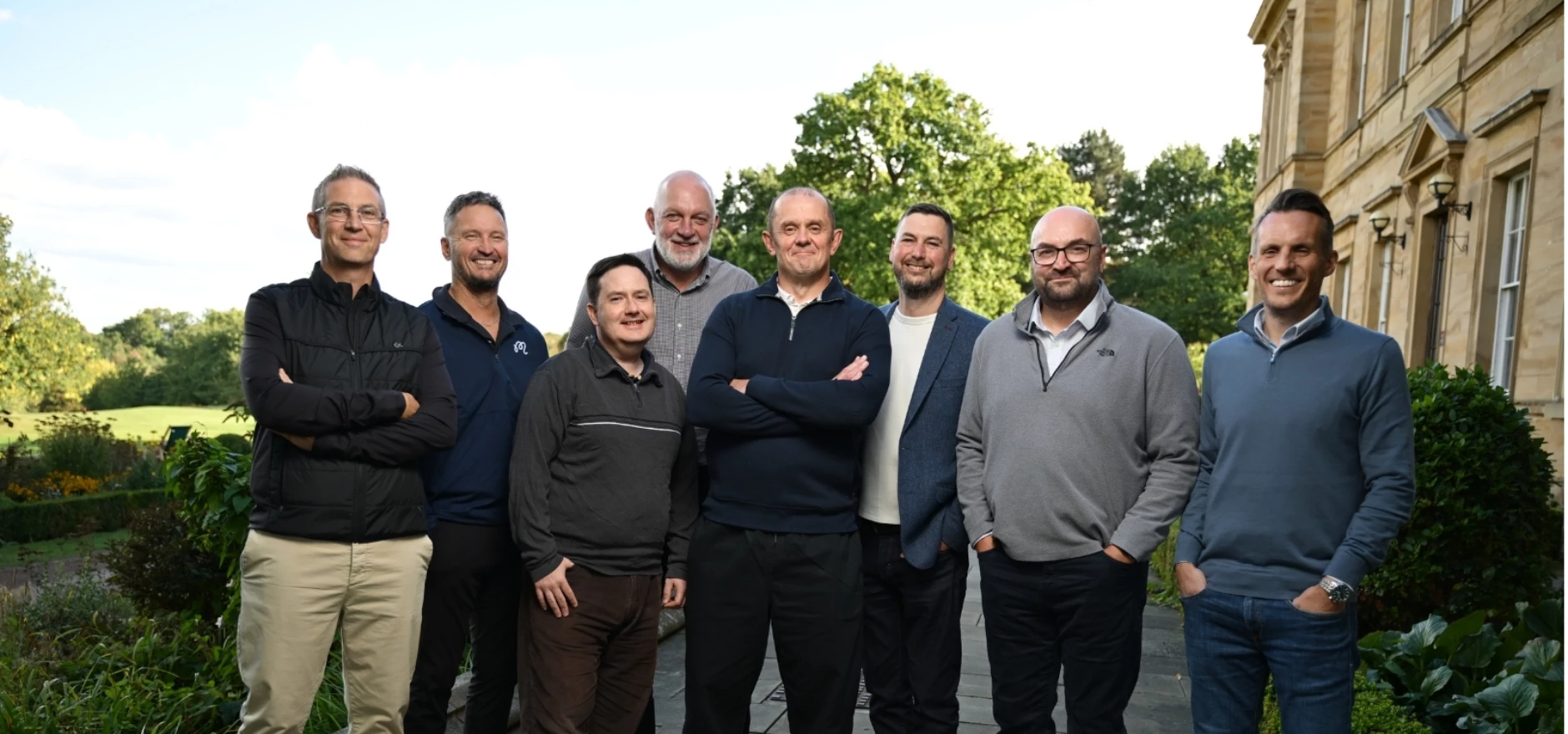

They add that as part of its next phase, the firm has appointed Keven Knight as chief executive and welcomed Matthew Briggs, former ECSC Group chief executive, as chair.

Keven said: “The mid-market is in a gap-zone of cybersecurity: too complex for basic tools, too niche for enterprise-level bespoke providers.

“Talion’s Hybrid Defence model fills that gap by offering transparency, shared control, and solutions scaled to the needs of firms that are growing fast but can’t afford to be overcharged or left exposed.

“With this investment, we can accelerate our innovation in MDR, threat intelligence, and service delivery for mid-sized enterprises.”

Dawn Tyler, investment director at Mercia Ventures, which first invested in Talion in 2021, added: “Talion is highly rated by clients and has attracted some well-known names.

“However, we believe the real opportunity now lies with medium-sized companies, whose needs are too complex for small providers but who are being overcharged and underserved by the big players.

“This funding will help it to establish a strong foothold in this part of the market.”

The £660 million Northern Powerhouse Investment Fund II (NPIF II) fund, operated by British Business Bank, provides loans from £25,000 to £2 million and equity investment up to £5 million to help small and medium-sized businesses.

Debbie Sorby, senior investment manager at the British Business Bank, added: “West Yorkshire is home to some exciting and fast-growing companies, and it is great that Talion is still setting the example when it comes to creating new solutions and competing alongside the nation’s leading cybersecurity companies.

“The first Northern Powerhouse Investment Fund is still leaving a lasting impact, helping businesses like Talion continue to access finance to grow.”

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular Yorkshire & The Humber morning email for free.

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses