Partner Article

Nick Hood’s Company Of The Month

Vertu Motors: battling on in the toughest of tough markets

The motor trade has been amongst the very hardest hit UK business sectors as the recession ground on and on, now being followed by the least vigorous recovery phase in living memory. Without the government’s car scrappage scheme, who knows how few motor retailers might have survived? As it is, the impact on the sector is well illustrated by the fact that it had the lowest average financial health rating on AIM at The London Stock Exchange in a recent survey.

It has been a huge struggle for companies to preserve wafer thin sales margins under intense competitive pressure, while continuing to fund the high quality showroom and service repair facilities demanded by customers made fickle by the wide range of discounts, incentives and choices available to them.

This is well illustrated by the financial profile of Vertu Motors, the AIM listed motor group based in Gateshead which owns the Bristol Street Motors, Macklin Motors and Vertu Honda businesses. Profits have held up remarkably well, even if they have been less than 1% of sales for the past two and a half years. The latest six months’ trading has produced pre-tax profits of just over £4m on sales of £547m.

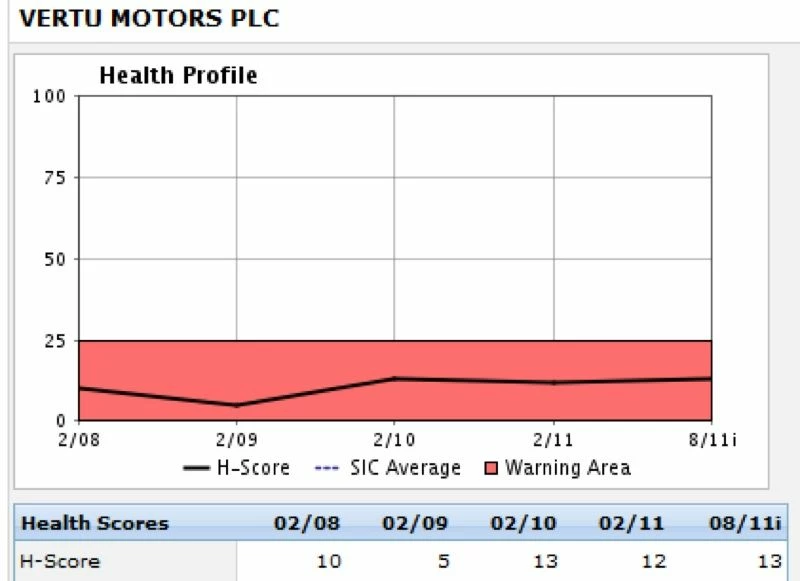

But making secure profits on a long term basis means having a solid balance sheet to support trading. Issues over the shape and interaction between Vertu’s assets and liabilities have held back Vertu’s overall financial health rating, keeping it solidly in the Company Watch warning area since as far back as when its February 2008 accounts were published.

Company Watch judges businesses on their published accounts after crunching their numbers through a sophisticated mathematical model, which examines seven key financial ratios and compares the results with other firms of similar size in their commercial sector. The outcome is the H-Score®, a financial health rating out of a maximum of 100. Any rating below 25 indicates an above average level of financial vulnerability. Clients use this data both for credit risk management and for monitoring supply chain disturbance risk.

Vertu’s Health profile appears below. Following its August 2011 interim accounts, its rating is only 13 out of a maximum of 100. There are no problems with profitability, current asset cover or the debt profile, but it scores poorly for liquidity, long term funding of its working capital and the amount of funding which is supported by ordinary trade credit, rather than by more secure sources such as equity or long term debt.

This picture has not changed significantly over an extended period, so that

management should be congratulated on steering the group through some very choppy financial seas without shipping too much water. But they will be anxious to improve the key financial ratios and see their health rating climb out of the warning area as soon as possible.

This was posted in Bdaily's Members' News section by Nick Hood .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning National email for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East