Partner Article

City centre apartments "must keep pace" with market recovery

Leeds city centre has enjoyed a huge amount of investment recently across its retail, leisure and office sectors and there is much more to come, but the city’s residential market must do more to keep pace according to city living specialist Morgans.

Last year saw the opening of Trinity Leeds and the First Direct Arena and now all eyes are on Hammerson’s Victoria Gate development.

In addition, work is underway on Leeds’ first five star hotel, which will operate as a Hilton Hotels & Resorts property, and a number of high profile new office buildings have recently received planning consent at MEPC’s Wellington Place project and Town Centre Securities’ Whitehall Riverside scheme.

However, according to Morgans, which employs a team of 40 at offices in Dock Street and North Leeds, high quality apartments in prime developments are extremely thin on the ground.

The company manages Leeds city centre’s largest property portfolio and its occupancy figures now stand at over 99%.

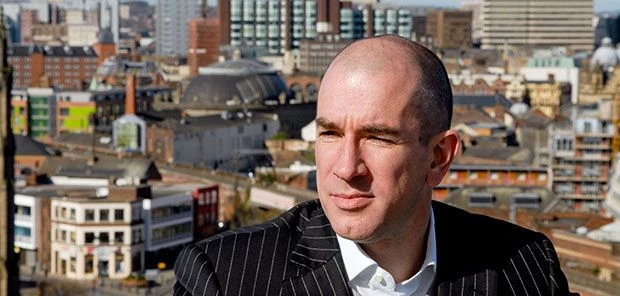

The firm’s managing director, Jonathan Morgan, explains: “The residential property market is a fierce place to be right now and we often have three or four people trying to rent every property we bring to the market.

“Often homes that are finished to a high standard, in a good location and realistically priced can let in less than a day.

“To put it in perspective, when we opened our doors back in 1997 there were only around 500 or so hardy souls living in the city.

“Today there are approximately 11,000 apartments in Leeds city centre which are home to around 14,000 residents and we estimate that only about 100 of these homes are currently sitting empty.

“We now need to significantly increase the number of apartments available in the city. Our estimates suggest the market could comfortably accommodate another 1,000 apartments in core locations but there are only around 300 in the pipeline over the next two years.

“Some of these are likely to be ‘built to rent’ which is obviously good for the rentals market.

“However, even though the rentals market is extremely buoyant at the moment, I don’t subscribe to the claims made about exponential and permanent growth in the rental sector.

“Most people in the UK still aspire to own their own home and as soon as they are able to access a reasonable mortgage deal, they will step onto the property ladder.

“We are already experiencing significantly improved sales activity in Leeds city centre and sold twice the number of apartments in 2013 compared to the previous year.”

Finally, Jonathan adds: “Leeds gained an unfair reputation as the ‘empty flats capital’ of the North in 2008 but as we predicted, supply dried up and demand continued to grow, so occupancy levels have risen and we now need the next generation of good quality new schemes.

“It great to see that Leeds is now making headlines for all the right reasons, attracting major investment and building a reputation as a city of real meaning.”

This was posted in Bdaily's Members' News section by Clare Burnett .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular Yorkshire & The Humber morning email for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East