Partner Article

Why alternative funding providers offer more

When it comes to giving your business a funding boost, you might have more options than you think to improve your cashflow.

But too many companies fail to realise the competitive advantages that can be gained by collaborating with the right credit provider. What are the reasons and how can they benefit when they do make the move?

Businesses are reluctant to look elsewhere

66% of SMEs looking for funding contacted just one provider

57 % of companies looking for funding talk to their existing bank first

Source: British Business Bank 2014 SME Journey to Raising Finance survey

33% SMEs have never changed their main finance provider

Source: Close Brothers Business Barometer

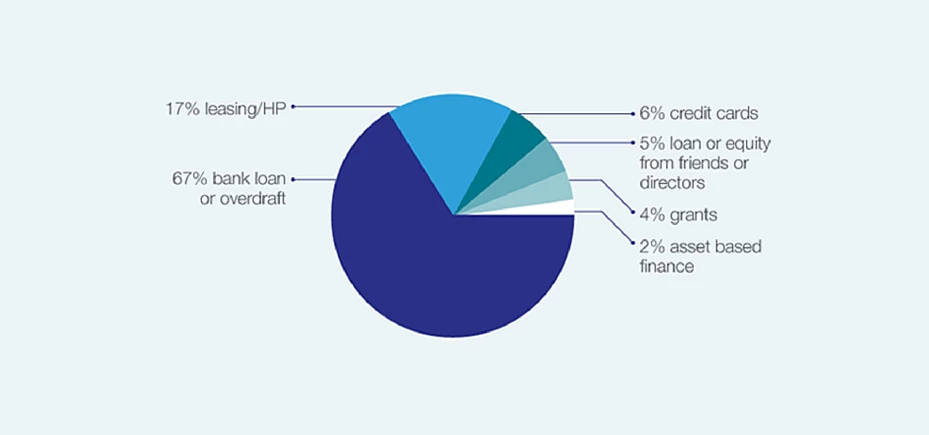

What finance options do firms look for?

There’s very little variety:

67% bank loan or overdraft

17% leasing/HP

6% credit cards

5% loan or equity from friends or directors

4% grants

2% asset finance

Source: British Business Bank 2014 SME Journey to Raising Finance survey

Main reasons for only approaching one provider:

59% Longstanding relationship

12% Too much hassle to shop around

10% Got all they needed from first provider

Source: British Business Bank 2014 SME Journey to Raising Finance survey

Banks don’t encourage their customers to go elsewhere if they are turned down for credit:

6% of firms are referred to alternative sources of funding

11% are offered alternative funding or advice

Source: SME finance: help to match SMEs rejected for finance with alternative lenders, Department for Business, Innovation and Skills

No time to shop around

When do SMEs apply for funding?

25% 1-4 weeks before the money is needed

40% Less than a week

17% 2-7 days

22% 2 days

1% After it is needed

8% Don’t know

Source: British Business Bank 2014 SME Journey to Raising Finance survey

Time well spent

How much time do firms invest in applying for funding?

40% 1 hour

20% 1-2 hours

10% 3-5 hours

11% 6-20 hours

15% 20+ hours

6% Don’t know

Source: British Business Bank 2014 SME Journey to Raising Finance survey

What are the benefits of shopping around for a better finance provider?

- More likely to get advice

Banks appear less willing to help: only 8% of firms got advice from their bank last year – down from 13% in 2012.

Source: Small Business Survey 2014: SME employers,BIS

- More likely to grow

Firms which collaborate with outside sources of guidance are more likely to thrive.

70% of firms in such partnerships survive over five years compared with 35% in the general SME population.

Source: A Guide to Business Mentoring, Federation of Small Businesses

What do firms do if they are turned down for funding by their first provider?

38% give up their search

23% negotiate

15% go elsewhere

26% use an existing form of finance

Source: British Business Bank 2014 SME Journey to Raising Finance survey

How easy do firms think it is to obtain finance?

26% Very difficult

32% Fairly difficult

19% Neither

9% Fairly easy

2% Very easy

12% Don’t know

Source: British Business Bank 2014 SME Journey to Raising Finance survey

How many assume banks are their only source of potential finance?

13% Strongly agree

18% Slightly agree

14% Neither

25% Slightly disagree

28% Strongly disagree

2% Don’t know

Source: British Business Bank 2014 SME Journey to Raising Finance survey

It pays to shop around

74% of companies say they rely on cash flow to fund future growth plans. Failure to secure funding severely limits their ability to expand or pursue new opportunities.

Source: British Business Bank 2014 SME Journey to Raising Finance survey

“Without taking the time to properly assess their situation and understand the full range of financial options available to them, small business owners and managers could miss out on opportunities for growth as the funding they have in place may not be fit for purpose.”

David Thomson, CEO, Close Brothers Invoice Finance

What next?

- Make sure you know all the options when you need additional funding

- Spend time to find providers who will work with you closely

- Understanding the full range of providers, not just traditional banks

- Approach potential lenders fully prepared with your business plan

For more information, get the guide: Stronger Together - the case for working in close partnership with a funding provider. Copy and paste this link into your browser: http://bit.ly/strongertogethereguide

This was posted in Bdaily's Members' News section by David Thomson .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning National email for free.

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses