Partner Article

FinTech pair see multi-million pound funding as sector continues to boom despite Brexit

A pair of FinTech firms in London have announced significant new funding today as the sector continues to perform strongly despite continued economic and political uncertainty.

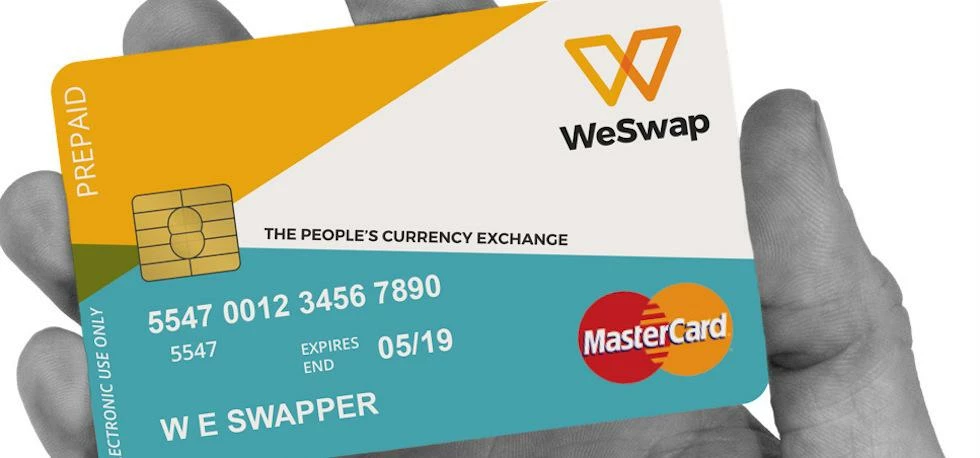

Investment and savings app Moneybox and money transfer firm WeSwap are both celebrating new funding rounds which have attracted big name backers.

Firstly WeSwap, which offers users currency exchange options by swapping cash with fellow travellers, has received $10m (approx. £7.7m) funding in a round led by Ascot Capital Partners with support from EC1 Capital and IW Capital.

The travel money firm, which was founded in 2011 before launching the product in 2013, is now available in over 10 countries and, according to Founder and Chief Executive Officer Jared Jesner, is now attracting ‘thousands of users’ who are swapping ‘millions of pounds’ a month.

Speaking about the FinTech firm’s plans for the funding, he said: “Our strong focus on building a sustainable, profitable business has enabled this funding despite the uncertain climate.

“The funding enables us to develop exciting new products, expand into new markets and continue to bring new features to our core product – all designed to help our users to stress less and travel happy.”

Meanwhile, London-based startup Moneybox has announced it has closed a $1.75m (approx. £1.3m) funding round led by Oxford Capital Partners, along with Ocado-backer Samos Investments and a lineup of individual investors from tech and finance.

Fonded in 2015, the firm’s app is due to launch in August and aims to get millennials to save by rounding up everyday card transactions and depositing them in an ISA.

Co-founder Ben Stanway commented: “We’re delighted to be working with Oxford Capital, who have such a great track record and understanding of our business. The funding will allow us to accelerate our product development and scale up the customer base.”

Both funding rounds attests to the FinTech sectors continued resilience in the face of economic and political uncertainty following last month’s Brexit vote, with many investment firms adopting a business as usual stance until it becomes clearer exactly what last month’s referendum will mean for the UK’s relationship with Europe and the world.

Commenting on Ascot’s investment in WeSwap, David Page, Chief Executive Officer at the firm, enthused about the UK’s pedigree as a financial and technological hub, and believes this will remain unaffected regardless of the outcome of the EU renegotiations.

He said: “The UK has always been, and will continue to be, a world-class financial services and technology hub with world-class resources and assets: including talent, innovation, legal framework and a supportive government.

“There will be a period of EU negotiations over the next two years but we can be sure the UK will remain at the forefront of global innovation and entrepreneurship.”

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning London email for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East