Partner Article

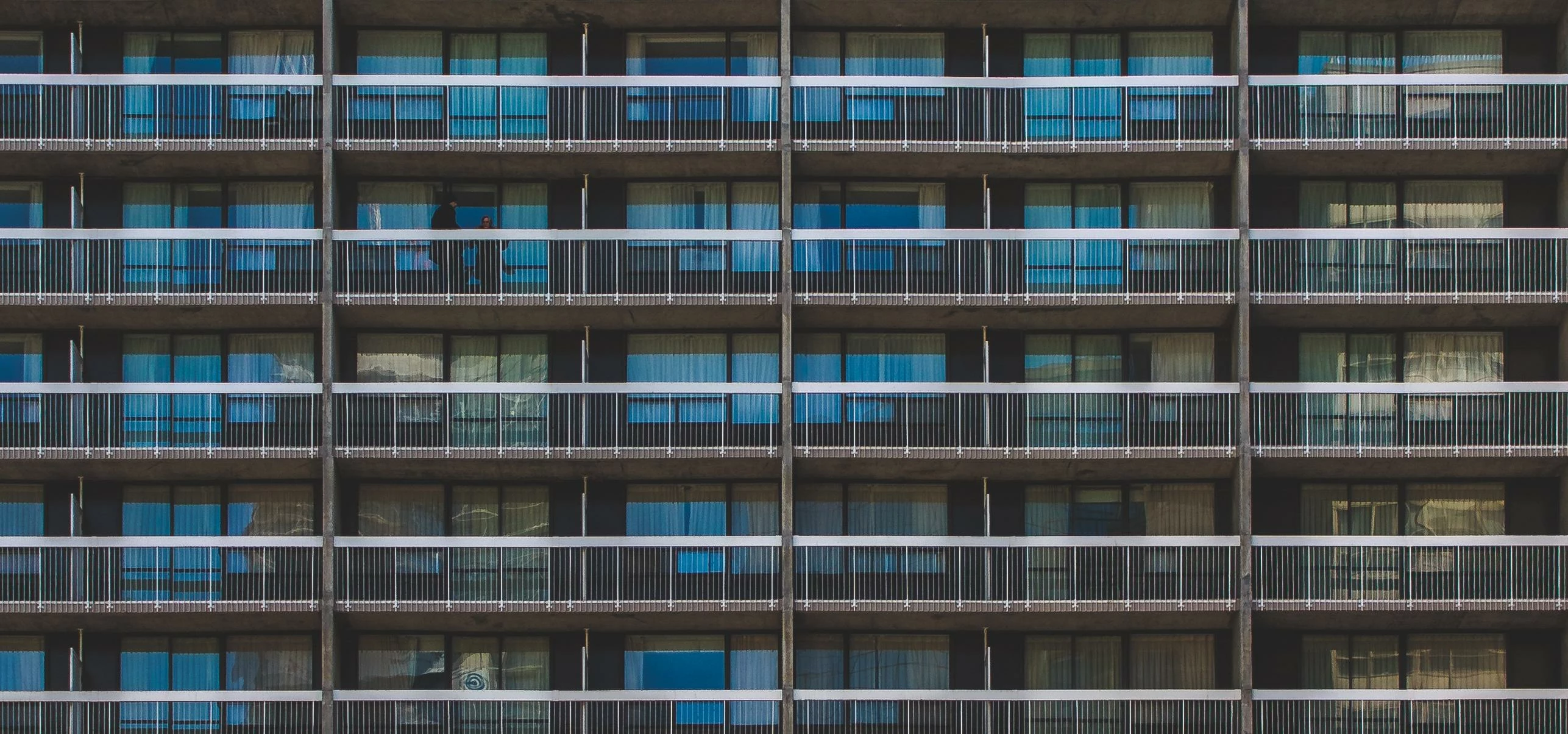

Advance of Funds Develops Apartment Living

Developer seeks out Holme Finance Bridging Solutions after financier refuses to release next stage of funds leaving the development of a block of flats in crisis.

Through no fault of his own the developer found himself vulnerable without the means to complete a schedule of works to complete his development.

Determined to avoid further delay he secured a £93,000 advance as a second charge from the HFBS team.

Ian Broadbent, director at Holme Finance Bridging Solutions says: “ The refusal from the initial financier to release the second stage of funds came as a complete shock to our client. The project could have quickly become a financial and personal crisis.

“After our assessment it was clear the client had a well thought out and costed schedule with a built in contingency. The block of flats was owned in a limited company name which meant we weren’t able to secure on that, nevertheless we were able to secure against a holiday let after a full valuation to allow this project to get back on track.”

Ian continues: “This was the first time he had heard of us, he was surprised to learn we could agree such terms without the need for solicitors and praised us highly for our speed, efficiency and ability to complete without two different sets of solicitors, which would have caused countless delays on the completion.”

HFBS Bridging Solutions have been advancing short-term funds, via a limited panel of intermediaries, for over 15 years with complete authority on their lending.

HFBS prides itself on being very different, filling a niche in the market to complement existing providers of short term finance and completing the more straight forward application without the need for solicitor involvement. Simpler, quicker, cheaper.

This was posted in Bdaily's Members' News section by Holme Finance Bridging Solutions .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular Yorkshire & The Humber morning email for free.

The value of using data like a Premier League club

The value of using data like a Premier League club

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector