Partner Article

What’s keeping social entrepreneurs awake at night?

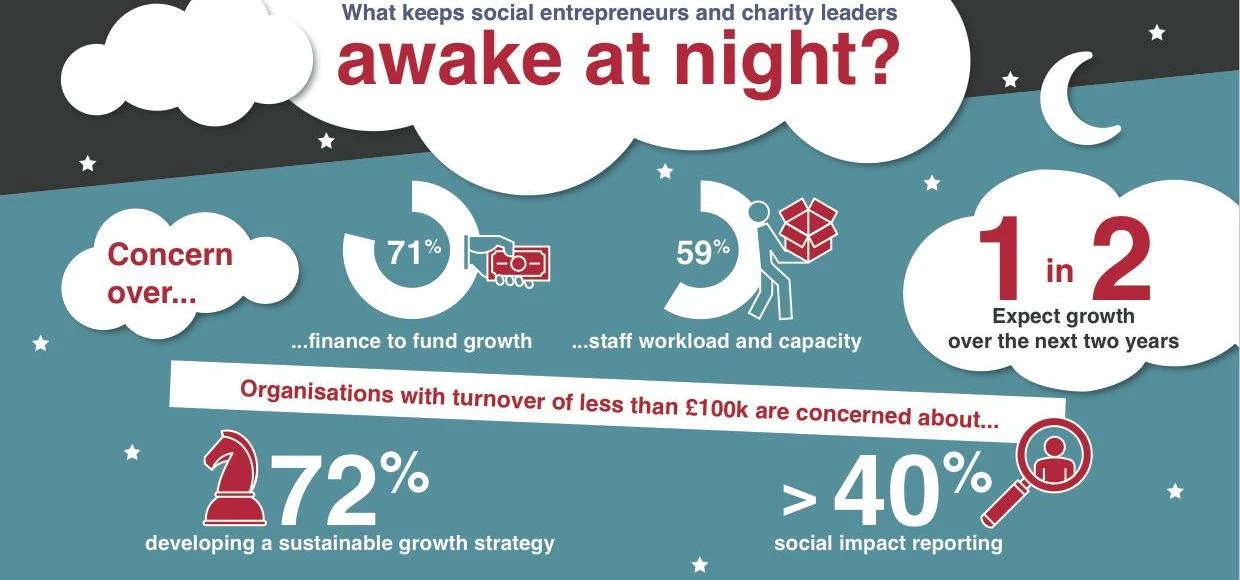

71% of VCSEs report concern over funding for both cashflow and growth

A snapshot survey from CAN, the social enterprise network providing office space, business support and social investment to voluntary, community and social enterprises (VCSEs) in London, has found that 71% of social venture leaders are kept awake at night because they are concerned or extremely concerned about access to finance to fund both cash flow and growth.

The survey was carried out to help inform the organisations soon-to-launch £50m social property fund, and CAN³, a new fast-growth programme designed to enable VCSEs to grow both their business and social impact.

Perhaps not surprising in the current climate of continuous cuts, the survey demonstrates that organisations are struggling to balance organisational growth with day-to-day cash flow and staff resource. With 59% expressing concern for staff workload and capacity, one respondent described the balance between the two as “rather a chicken and egg situation”.

Though on a positive note, more than one in two organisations surveyed expects growth over the next two years, the survey data highlights the struggles of social organisations grappling with making impact, and ensuring they have the financial capacity and right business strategy in place to stay afloat.

One social enterprise leader said: “Finding the money to cash flow the business and at the same time to grow our capacity is always a challenge. It’s about getting that balance between delivering the most impact and building a robust business model.”

Of organisations with turnover of less than £100k, 72% were concerned or extremely concerned about developing a sustainable growth strategy, while more than 40% expressed specific concern over social impact reporting.

Andrew Croft, Chief Executive of CAN, said: “With the current state of play, organisations have got to consider a more diverse set of funding options. It’s not one size fits all. The desire to demonstrate and report on social impact is an encouraging outcome, and proving impact will help social organisations be more likely to successfully diversify income.”

The survey found that 42% of organisations within the £100-£500k turnover bracket said they found it difficult or impossible to access social investment, while 55% of all organisations surveyed said they had the same difficulty accessing traditional lending.

52% of all organisations ranging in turnover from under £100k to over £1.5m said that they find it difficult or impossible to access public sector funding, and 51% said the same of restricted grants from trusts and foundations.

One respondent said: “Despite running a profitable and healthy CIC, because external funders and partners are not informed we are often seen as a ‘hybrid’ type set up that doesn’t fit any of their profiles for working with. Lenders don’t like us because they think we are ‘non-profit’ (not true) and public sector/third sector don’t trust us because we are ‘too commercial’.”

Respondents put difficulties accessing funding advice and business support primarily down to lack of funding (57%) and lack of time (64%), while 53% said they didn’t know who to ask, or were unaware of what support and finance is available.

In spite of the difficulty many social organisations have with generating income, the survey identified a healthy appetite for different types of revenue and finance from VCSEs:

Traded income 75% Private contracts 56% Public sector contracts 52% Restricted grants 67% Donations 58% Social investment 39%

The survey gives CAN food for thought, and is helping to shape CAN³, the new accelerator programme launched to support VCSEs within its flagship building and subsidising the costs of 10 to 15 organisations over one to three years. Specifically, these organisations will get extensive help on cash flow and financial modelling for growth and impact.

Designed to fill the vacuum in support for post-startup social organisations the CAN³ programme combines the investment and business expertise of the CAN Invest team with the dedicated office space of CAN Mezzanine, to support and accelerate growth, build sustainable revenue and focus on social impact.

Andrew Croft continued: “It’s not surprising to see the lack of support in terms of finance and business strategy expressed by the social sector. While some organisations in our sector are thriving, there is still a vacuum, where many are struggling to meet their social objectives while still achieving significant financial and organisational growth. Business advisory support needs to be better, and we need more new, innovative funding streams from social investors and trust and foundations. We hope that CAN³ will help address some of these challenges.”

This was posted in Bdaily's Members' News section by CAN .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning London email for free.

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses

A year of growth, collaboration and impact

A year of growth, collaboration and impact

2000 reasons for North East business positivity

2000 reasons for North East business positivity

How to make your growth strategy deliver in 2026

How to make your growth strategy deliver in 2026

Powering a new wave of regional screen indies

Powering a new wave of regional screen indies

A new year and a new outlook for property scene

A new year and a new outlook for property scene

Zero per cent - but maximum brand exposure

Zero per cent - but maximum brand exposure

We don’t talk about money stress enough

We don’t talk about money stress enough

A year of resilience, growth and collaboration

A year of resilience, growth and collaboration

Apprenticeships: Lower standards risk safety

Apprenticeships: Lower standards risk safety

Keeping it reel: Creating video in an authenticity era

Keeping it reel: Creating video in an authenticity era