Partner Article

GBP Stares Down the Barrel While FTSE Soars

The FTSE 100 index is riding a wave of bullish sentiment. The recent performance of the all share index has outperformed expectations, posting its best winning streak in 33 years. The GBP has hit a multi-month low, after Prime Minister Theresa May announced that Britain would be seeking a Brexit as soon as possible. The ongoing weakness of the GBP is helping to drive up the FTSE 100 index.

The inverse relationship between the FTSE 100 and the GBP is a direct result of foreign companies comprising the bulk of the earning potential in the FTSE 100 index. When euros, yen and dollars are converted into sterling the sterling value appreciates. This paints a skewed picture of the performance of the FTSE 100 index.

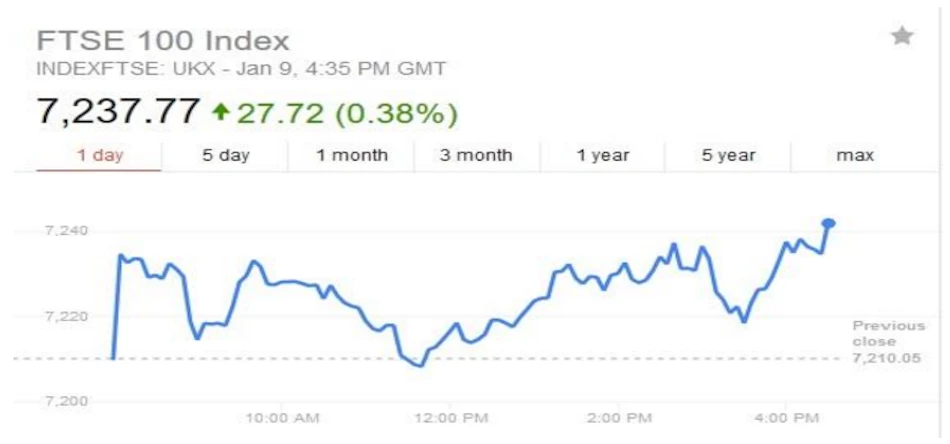

During the day on Monday, 9 January 2017, the FTSE 100 index touched 7,243.76 before retreating. Tremendous levels of currency trading activity were noted in the City of London, with call options on the USD and put options on the GBP/USD pair. The DXY (US Dollar Index) is hovering around 14-year highs and this driving down the cable. The dollar’s run on the sterling was assisted by speculators who fear a hard Brexit. The FTSE 100 index closed at a record level for the eighth day on the trot, besting records last seen in 1997.

The recent performance of the FTSE 100 index is unlike anything we have seen in recent history. The latest Bull Run began towards the end of December at the height of the Christmas shopping season with trading reaching a crescendo. The rally has continued into 2017, fueled in strong part by weakness in the GBP.

The performance of the FTSE 100 index is in stark contrast to the performance of indices across Europe. The inverse relationship between Britain’s premier index and its currency is well-known. The FTSE 100 has been posting strong gains ever since the June 23 Brexit referendum, and momentum has never let up.

Is a Hard Brexit In-Store for the United Kingdom?

The 28-point gain on Monday, 9 January allowed the index to reach a new record. Of course, the 1% slide against the greenback and the 2% slide against the euro are fueling the latest rally on the London Stock Exchange (LSE). The foreign earnings generated by companies listed on the FTSE 100 index are worth more when converted into GBP as the sterling depreciates.

However, it was Britain’s Prime Minister who kick started the fresh new rally by promising to take control of immigration and of the country’s rule of law. Prime Minister May ruled out the prospect of bits and pieces membership of the European Union, and presented the prospect of a hard Brexit.

For her part, the Prime Minister rejects the notion of a soft Brexit or a hard Brexit. She also held firm on her position to lead the UK out of the EU. To do so, Article 50 of the Lisbon Treaty must be invoked. Once that is done, Britain will have 2 years to get things in order before its membership of the EU is effectively terminated.

Brexit uncertainty remains the most pressing concern for the UK economy. However, it is not all doom and gloom for Britain. Consumer stocks and basic resources are performing well. The top gainers in the all share index included BHP Billiton, Randgold Resources and the biggest gainer, Glencore up +3.6%. Mining stocks have been propelling the FTSE 100 index in recent days, with strong support from the energy sector too.

This was posted in Bdaily's Members' News section by Boris Dzhingarov .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning National email for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East