Partner Article

P2P lender Kuflink has received full FCA authorisation

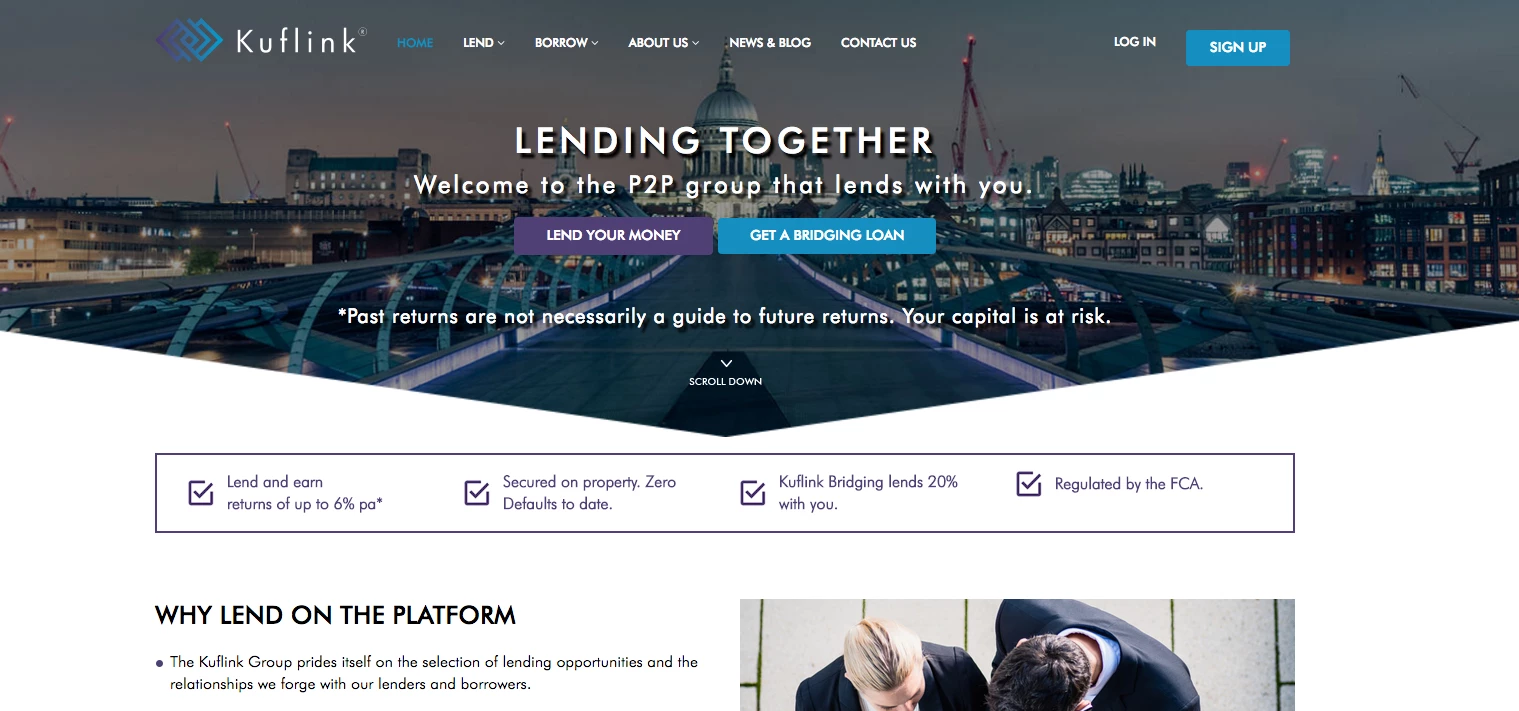

A recently launched peer-to-peer (P2P) lender offering investors the chance to invest their cash in bridging loans has received full authorisation from the Financial Conduct Authority (FCA).

London-based Kuflink has joined an illustrious handful of P2P lenders to attain full FCA authorisation, and one of the few to be operating in the property sector, meaning it will now be able to launch its ISA product within weeks.

Authorisation comes just eight months after the lender launched as part of the wider Kuflink Group, which itself has been operating since 2011.

A key part of Kuflink’s proposition is that the lender stumps up the first 20% of any deal on its platform through its Kuflink Bridging arm, which itself became fully FCA regulated back in October, helping to shore up confidence as it invests alongside individual investors.

As a further protection, the firm also carries out its own vetting and due diligence and a separate credit committee which runs the rule over all bridging transactions carried out on the platform.

Tarlochan Garcha, Chief Executive Officer at Kuflink, said the announcement was part of the lender’s efforts to ‘fortify’ its position in the P2P lending and bridging space.

He said: “Through our hard work and determination, our authorisation from the FCA validates our delivery of a regulated peer-to-peer service that allows our customers to engage and transact in a safe and secure environment.

“I’m excited to announce that we are already preparing to launch an ISA as part of our services next month, and we look forward to supporting our expanding customer base over the course of the year.”

There has been a rush of P2P lenders seeking full FCA authorisation in recent months as alternative lenders have raced to get the necessary regulation in place to offer their own Innovative Finance ISA (IFISA) products.

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning London email for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East