Partner Article

Tyneside Global Digital Agency Reacts To Its Staggering Multi-Billion Dollar Ad Spend

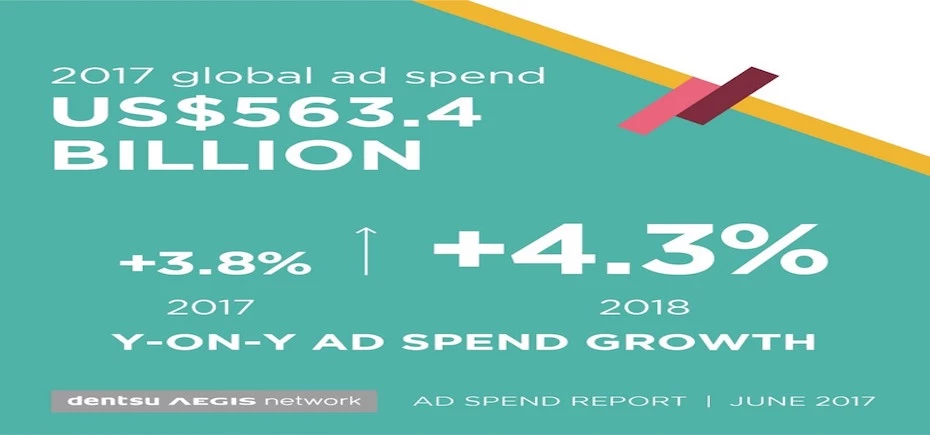

One the world’s largest digital agencies has revealed that its client Ad spend is set to smash the $563.4 Billion mark in 2017 despite a turbulent market post-Brexit.

Dentsu Aegis, which opened an office in Newcastle two years ago in response to demand for its services, has revealed that its UK ad spend has also performed better than expected as the company looks forward to yet more rapid growth over the next 12 months.

Dentsu Aegis Network, which expanded into Newcastle to house two of its communication divisions, iProspect & Carat, currently employs 550 staff from its four offices across the North of England and boasts many of the North East’s heavyweight brands including Greggs, Home Group, Northgate, NE1, TLW Solicitors and Eldon Square.

Commenting on the latest ad spend forecasts, Jerry Buhlmann, Global CEO of Dentsu Aegis Network, said: “We are reaching a tipping point in ad spend now as digital overtakes television, mobile overtakes desktop and paid search overtakes print.

Digital and data must now be the default settings for advertisers. Evolving to people-based marketing rather than audience-based marketing and using data to increase addressability is essential for brands to manage tighter conditions in 2017 while positioning themselves for future growth.“

“At the same time, the challenge for brands is to ensure that they are ready to embrace the potential of new innovation. As technologies such as virtual reality and voice activation become more prominent, brands must ensure that they remain relevant by creating new value for their consumers.”

Based on data received from 59 markets across the Americas, Asia Pacific and EMEA, Dentsu Aegis Network’s Ad Spend Report – June 2017 points to a more cautious economic outlook in 2017 than the previous year, with global ad spend falling from 4.8% to 3.8% (see Figure 1).

However, conditions are set to improve in 2018 with forecast growth of 4.3%. The company has said that events will play a key role in bolstering ad spend growth in 2018, with events such as the Winter Olympics & Paralympics in South Korea, the FIFA World Cup in Russia and the US Congressional elections all expected to stimulate growth.

And, despite concerns about the economic impact of Britain’s decision to leave the European Union, UK ad spend held up better than expected in 2016 at 6.1%.

While there are signs of caution in 2017, with growth dipping to 4%, 2018 is forecast to see growth bounce back to 5.9%. A similar picture unfolds in the United States, where a slowdown to 3.6% is forecast for 2017, followed by a slight improvement in 2018 to 4.0%.

The United States also remains the largest market in the world, accounting for 37.7% of global advertising spend. Advertising spend in emerging markets continues to outpace developed economies. For example, ad spend in India is forecast to grow at 13% in 2017, while China is the second largest market in the world by share of advertising spend—remaining the only emerging economy to feature in the top five largest ad markets.

Dentsu Aegis’ forecasts show how digital technology continues to disrupt and drive innovation in the way brands connect with their consumers. In 2017, it forecasts that advertising spend on mobile will overtake desktop in terms of share of global advertising spend, reaching 56% and accounting for a total of US$116.1 billion.

With smartphone subscriptions set to reach 4 billion by 2025 and about a third of consumers reporting that their smartphone is their primary source of entertainment, we can expect to see this trend continue to strengthen.

While digital ad spend is growing rapidly and set to overtake television, within digital, there are a number of new sources of growth that point to the future of advertising.

In 2017, online video is set to grow by 32.4%; social by 28.9%; and programmatic (i.e. automated ad buying) by 25.4%. Looking ahead, the company has said that brands will need to embrace the potential of disruptive technologies such as virtual reality, artificial intelligence and voice activation. However, research suggests that only 8% of brands currently intend to use virtual reality for advertising purposes.

This was posted in Bdaily's Members' News section by Jane Crosby .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our daily bulletin, sent to your inbox, for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East