Partner Article

Digital assistant Cleo wants to become the 'financial interface for a generation' after Robin Klein backing

London-based FinTech startup Cleo has closed a £2m funding round just seven months after launch, with impressive user growth and retention figures attracting some of the biggest names in venture capital.

In the round, which has been confirmed today, star VC Robin Klein of LocalGlobe has invested alongside previous backers Niklas Zennstrom, the founder of Skype, and FinTech investor Errol Damelin.

The startup burst onto London’s crowded FinTech scene earlier in the year after it received an initial $700k investment from a string of angel investors, with the likes of Zennstrom and Lovefilm Co-Founder Simon Franks clearly taken in by the firm’s vision of an AI digital assistant overseeing your personal finances.

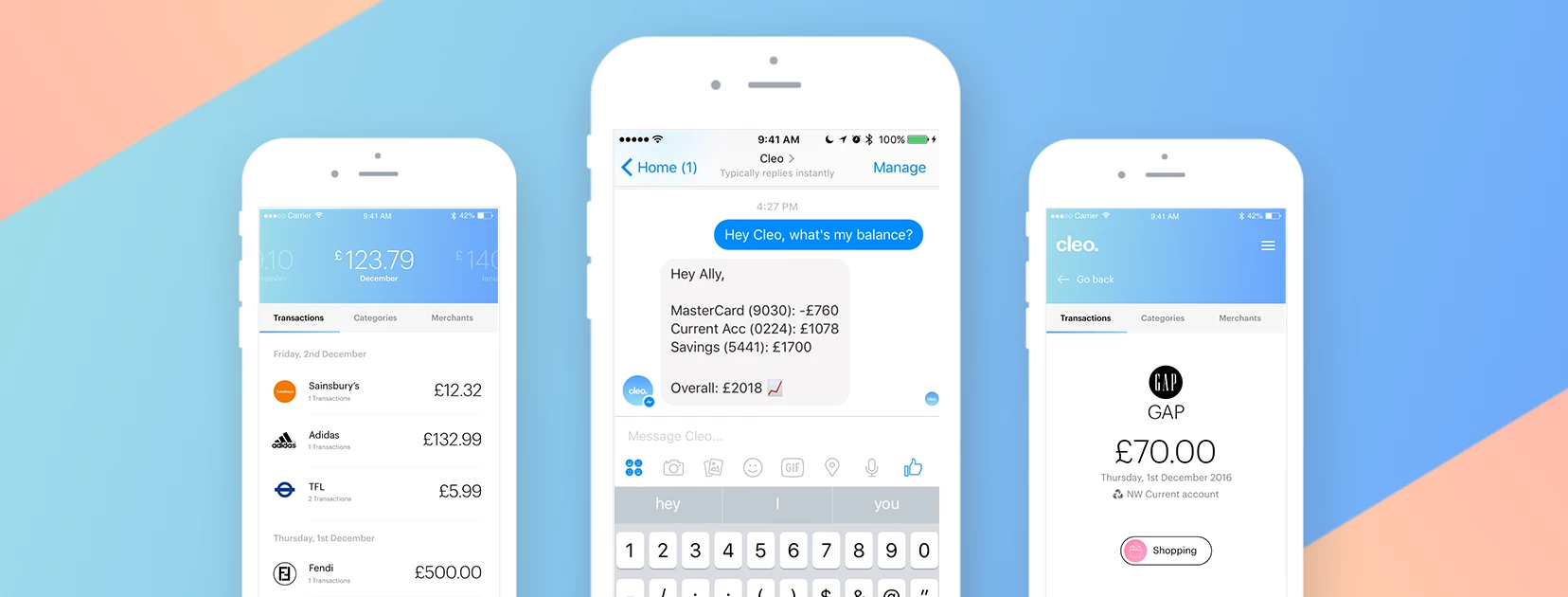

Through Facebook Messenger and the startup’s app, the eponymous Cleo is able to provide detailed account information and analysis through its chat interface, advising users on their expenditure, helping them to budget and even suggesting better credit and loan products on more favourable terms.

Speaking with Co-Founder Barney Hussey-Yeo, the Bristol University graduate and former Wonga employee explained how Cleo’s vision expands beyond merely providing users with updates on their balance or help budgeting. Instead he sees the platform as a salve to the famously archaic and ‘incredibly broken’ financial services framework.

He explained: “The fact that you get an overdraft and a credit card as a student, and even myself I was earning a good wage as a data scientist but still had overdraft fees, still had credit cards.

“I had no idea where my money was going, had no idea how much I could afford to spend, how much I could be spending. I just find it kind of crazy that as a data scientist I couldn’t do this myself at Wonga.”

The above is likely to draw nods of agreement amongst large swathes of the population, particularly the much vaunted (and maligned) Millennials demographic for whom the never-ending hamster wheel of overdraft fees and credit card interest is an all too familiar struggle.

In response, Hussey-Yeo decided to build an early version of Cleo for himself and hacked together a script which pulled information from his bank account and provided him with updates on his spending.

A positive response from friends to his proto-Cleo suggested early on that he might be on to something.

“I just showed it to some friends and they loved it,” he said. “They started using it and from then I was like there’s something really here.

“There’s nothing that’s intelligent in banking or financial services, there has to be something better. I was just like screw it I’m going to build this.”

A stint in company builder Entrepreneur First alongside Co-Founder Aleksandra Wozniak followed and led on to its early funding and explosive user growth over the last six months.

According to the startup’s own figures, 40% of its 50,000 early adopters interact with Cleo on a daily basis with an impressive 70% returning regularly within three months of signing up and 77% dumping their bank’s app altogether after three months.

The firm has also built up an impressive following on social media, boasting over 9,000 followers on Twitter, a large proportion of whom seem continually delighted by Cleo’s smart replies and witty gifs.

Such positive engagement is both a vindication of the natural language processing (NLP) technology that underlies the platform and powers Cleo’s responses, as well as a realisation of the allure that chatbots pose for users.

Throughout the conversation Barney repeatedly refers Cleo by a female personal pronoun and the startup has worked hard to personify the bot’s tone of voice in an approachable and believable way.

It goes without saying that he’s backing digital assistants to be the future of apps and central to our digital lives, with the likes of Google and Apple already driving uptake and widespread adoption, and he sees Cleo as riding this ‘wave of innovation’.

Over the next five years Barney and Cleo are looking to embark on an ‘aggressive’ international expansion, particularly in the US, with ambitions to turn its 50,000 users into 500,000 as it continues to scale and grab more users from the incumbent banks and financial providers.

“We want to be that one financial interface for the future,” Barney concluded. “And it’s really working, we have a core group of users that really love the product. They love that we’ve made something so dull and horrible fun.”

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning London email for free.

The value of using data like a Premier League club

The value of using data like a Premier League club

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector