Partner Article

Cramlington electronics manufacturer to follow strong first year with £300k growth investment

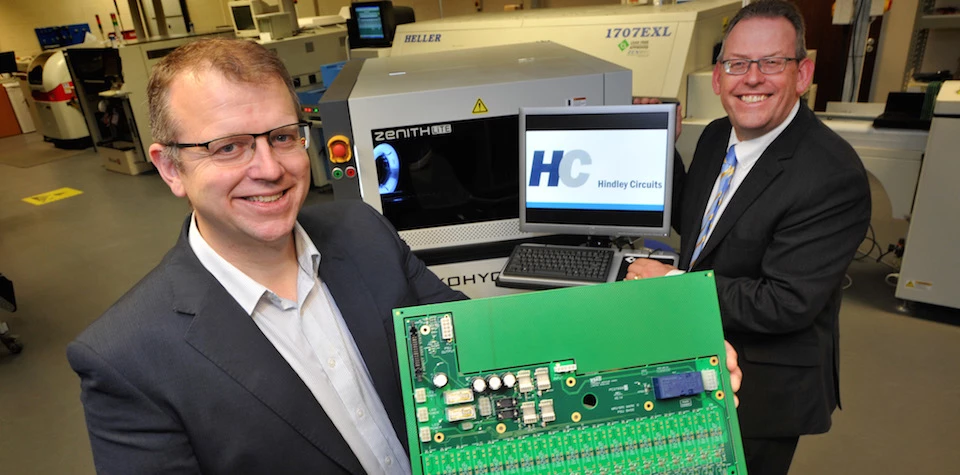

Electronics manufacturer Hindley Circuits is embarking on a new investment strategy following a strong first year in business.

Investing over £300k in new technology, the Cramlington-based company has also revealed plans to create new jobs in the region.

The announcement is particularly pleasing for the group behind the business, led by Andrew Lapping, Bim Sandhu, Chris Pennison and Sarah-Jane Moffat, who bought the assets of a collapsing parent company only this time last year.

Hindley Circuits bought the assets of Opsol Limited, which employed 23 people, from administrator Deloitte LLP, following the collapse of its parent, A-Belco.

The investors supported the Opsol management team led by Richard Whitehead, chief executive of the new business, which has already increased headcount to 36 staff and from a standing start is set to record approximately £2.5 million turnover in its first year of trading.

Richard, said: “Opsol was a solid, profitable business and in creating Hindley Circuits, we wanted to preserve all that was good whilst establishing a new, energetic and highly flexible business in partnership with our customers.

“Like all businesses, there is always the opportunity to improve and go beyond what was previously attained and that is the journey Hindley is on at every level. In a short space of time, we have increased our headcount and that is a matter of great pride to us.

“The first year of business has been challenging. That said, it is satisfying that exactly 12 months after rescuing the business, we are now investing heavily to take it to a new level.

“Our initial task was to regain the confidence of the customer base, the majority of which are based in the North East. As a local business ourselves, they were willing to trust in our recovery and move forwards.

“Once they realised we had a stable business, a very strong management team and ambitious plans for both investment and growth, we have seen many return.

“Very pleasingly, we have also converted a number of new, high quality customers, some within the region but others further afield, which has given us the confidence to take on new staff and also commit to further investment in our plant and technology.”

In addition to expanding Hindley’s customer base, the management team is also keen to assess the potential for strategic acquisitions.

Fellow director, Chris Pennison, said: “We are looking at all options for growth. We are developing an entrepreneurial culture and while we have a strong focus on the development of the Hindley brand, we will look at wider opportunities and especially the potential for acquisitions.

“We have the support and the vision, it’s just all about timing. We have already shortlisted and reviewed several businesses and any acquisitions will be complementary to achieving our vision.”

The biggest single investment made by Hindley so far is in a 3D automated optical inspection system from Korean company Koh Young.

Richard Whitehead, said: “This is truly advanced technology within our sector and will have a significant impact on our production process. You would expect to view this technology within large EMS providers.

“The fact that, as an emerging business, we have the ambition and resource to invest in this way, is a clear signal to existing and prospective customers that we are looking to be a major player in the market.”

Amongst the array of technologies being introduced to the business are the Z- Check Z100 3D pre assembly solder paste inspection system, the Mantis Vision stereo microscopes with image capture, an Inspect digital viewing and image capture system, a Ersascope BGA inspection system, an Accuseal dry pack resealing and gas purge system for re-packaging moisture sensitive devices and a Blundell Cropmatic conventional lead cropping machine.

Richard, added: “These investments are just the start. Our intention is to be regarded by our peers and customers as a highly capable, service driven business. We have the right investors, right equipment and the right people.”

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our daily bulletin, sent to your inbox, for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East