Partner Article

Are Retirement Savers about to face a Crisis?

A looming State Pension funding crisis could have severe consequences for those saving for retirement, if action is not taken. Paul Gilsenan, Principal of Paul Gilsenan Wealth Management – a Partner Practice of St. James’s Place Wealth Management – explores the need for retirement savers to make the most of available reliefs and allowances.

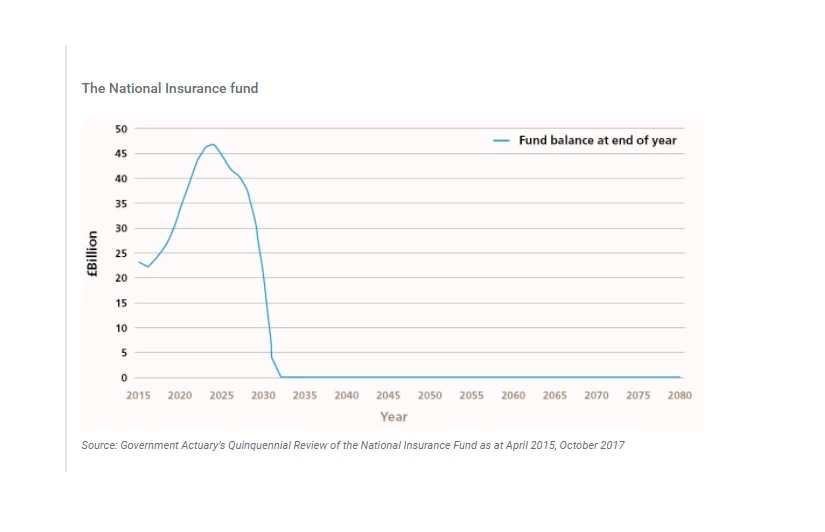

Philip Hammond may have claimed in his Spring Statement that “there is light at the end of the tunnel” in rebuilding the UK’s finances, yet a paper published by the Government Actuary’s Department (GAD) has uncovered a potential hole in the public purse that could mean that the National Insurance Fund – from which State Pension payments are made – will run out in the early 2030s.

The report identifies a mismatch between the amount of money coming in through National Insurance contributions (NICs) and the amount going out in benefits – over 90% of which is absorbed by the State Pension.

What does the future hold?

The balance of the fund currently stands at around £25 billion. Indeed, the short-term picture looks fairly healthy, as factors such as the rising State Pension age boost NIC receipts. However, the declining ratio of those in work to those in retirement, and the impact of the State Pension triple-lock – which guarantees that payments rise in line with the highest of average earnings, inflation or 2.5% – sees the size of the fund plummet from 2025 onwards. Under current assumptions, the fund will be exhausted from around 2032.

“If the system is to continue to cover the current form of State Pension and other benefits, then either the fund’s income has to rise or expenditure has to be controlled,” says Martin Lunnon of GAD.

State Pension funding – a looming crisis?

To continue paying the State Pension in its current form, the government must find an extra £11.6 billion by 2030, rising to £55.9 billion by 2040. How it responds to ensure that additional funds are found in time is now the key question.

In the wake of one of the longest and deepest financial squeezes in history, it’s hard to envisage cuts to key public services. Likewise, any further attempt to hike NICs is likely to spark the same firestorm that engulfed the Conservative Party a year ago, when it proposed changes for the self-employed. Indeed, “substantial increases in National Insurance contribution rates would both be particularly politically sensitive and would again require primary legislation,” notes GAD.

Against that backdrop, the government could be forced to look elsewhere. It is already proceeding with an accelerated increase in the State Pension age, and it’s quite possible that this will have to rise further and/or faster than the current timetable.

What are the consequences for savers?

The government could be compelled to cut back on allowances and benefits provided to savers. Tax relief on pension contributions has been at the mercy of cash-strapped chancellors for some time, but whether this government has the appetite to abolish the higher and additional rates remains to be seen. Nevertheless, it spent more than £50 billion on tax relief last year (HMRC statistics, 2018), prompting speculation that the system will be overhauled in the near future.

It may well see more ‘salami slicing’ as the answer. The annual allowance for pension contributions came down from £255,000 a year, to £50,000 then £40,000. However, some top earners can see their annual allowance reduced to just £10,000 under new rules. It’s quite possible that those earning more modest sums could see a reduction applied to their allowance in future, making it much harder for them to build a sufficient retirement fund.

Whatever happens, pension tax breaks for high earners are unlikely to become more attractive. It also seems inevitable that individuals will become increasingly responsible for funding their retirement as state benefits come under greater pressure.

What action can savers take?

As we approach the end of the tax year, those who can should try to take advantage of the generous reliefs and allowances while they are still available. This means making the most of this year’s annual allowance and carrying forward any unused allowances from the three previous tax years. That way, individuals can benefit from current rates of tax relief and potentially enjoy a higher income when they stop work.

This was posted in Bdaily's Members' News section by PSG Wealth Management Ltd .

The value of using data like a Premier League club

The value of using data like a Premier League club

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector