Partner Article

Help to Buy Extended to 2023 for First Time Buyers

Justin Gaze, Head of Residential Development Land at Knight Frank commented: The Help to Buy Equity Loan will be extended to 2023 for First time buyers only. There will be varying capital value limits across the regions from 2021.

“Some much needed clarity on Help to Buy is positive development.

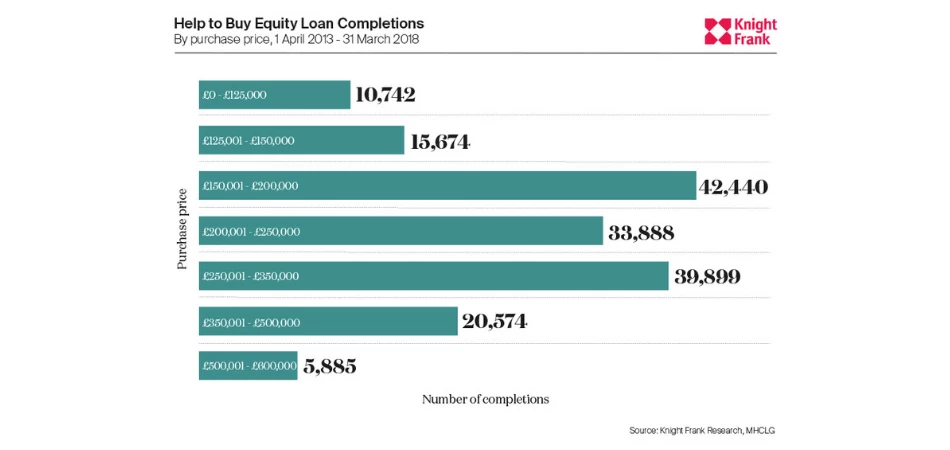

“No industry should be reliant on government assistance indefinitely, so the decision by ministers to restrict the scheme to first time buyers with regional purchase price caps is a sensible one. Some 81% of equity loans since 2013 have been taken out by first-time buyers.”

“However, the ‘deposit gap’ that the Help to Buy equity loan scheme was established to overcome is still very much a problem. U.K. house prices are 37% higher than when the scheme was introduced in 2013 and the mortgage market for those with only a 5% deposit remains very thin. For prospective buyers, finding the funds for a deposit will remain the biggest barrier to home ownership.

“From 2023, the onus will move to mortgage lenders and the development community to help buyers bridge this gap.”

Grainne Gilmore, Knight Frank’s Head of UK Residential Research, commented: “The extension of the first-time buyer stamp duty relief for those purchasing through shared ownership is an positive move to help more buyers onto the housing ladder. It was an unusual move by the Chancellor to backdate his decision, which will mean thousands of extra new homeowners will also receive a surprise rebate.”

SDLT - Liam Bailey, global head of research at Knight Frank, commented: “Philip Hammond announced today that the government will publish a consultation in January 2019 on a SDLT surcharge of 1% for non-residents buying residential property in England and Northern Ireland.

“A new additional rate of stamp duty for foreign purchasers of residential property will undermine investment in new housing in London and across the UK.

“The most recent academic investigation* confirms that rather than raising house prices, foreign purchases of new build property help to fund, and therefore facilitate, the delivery of much needed accommodation.

“Further, this new proposal is another in a long line of tax changes which have acted to weigh on property transactions by raising costs and creating market uncertainty and, according to the government’s own data, are now helping to reduce market liquidity and stamp duty tax take.

“Stamp duty receipts from residential property transactions fell by 6.1%**** in the first six months of 2018 compared to the same period in 2017. This decline equates to a reduction in tax take of more than £250m in the first half of this year.

“The need for a truly accessible housing market is well articulated by politicians - the challenge is to create policies which aid this objective rather than hinder it.

“Stamp duty is a badly designed tax which reduces the efficient allocation of property, limits labour market mobility, reduces the ability of families to access housing that fits their requirements and ultimately reduces supply of new homes.”

Notes:-

*“The pattern after 2010, when the effects of the financial crisis were at their worst, suggests that overseas investment since then has had a positive net effect on the availability to Londoners of new housing, both private and affordable.” Source: http://www.lse.ac.uk/business-and-consultancy/consulting/assets/documents/the-role-of-overseas-investors-in-the-london-new-build-residential-market.pdf

****This figure is an accurate like for like comparison which makes an allowance for both the Stamp Duty Relief for first time buyers and the fact that since Q2 this year receipts from Wales and England are reported separately.

This was posted in Bdaily's Members' News section by Robert Beaumont .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular Yorkshire & The Humber morning email for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East