UK-Israeli startup Sharegain raises $12m for fintech platform roll-out

UK-Israeli fintech startup Sharegain has raised $5m (c.£3.84m) to support the roll-out of its securities lending platform to private banks, online brokers and robo-advisers.

The investment, bringing the total to $12m (c.£9.23m), will also allow the Islington-based firm to scale its operations with family offices and asset management firms.

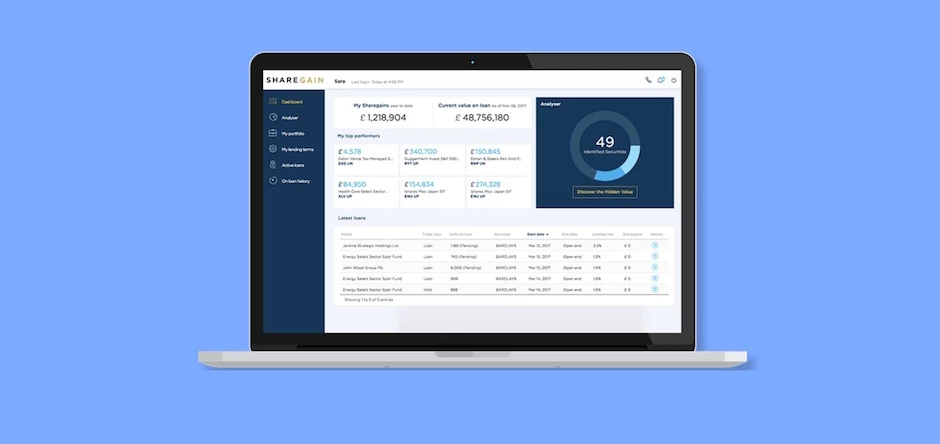

Sharegain’s digital tool enables investors to generate revenues by loaning out their financial assets.

For more than 40 years, some of the world’s biggest investors have generated additional gains through securities lending, which involves loaning out stocks, bonds and Exchange Traded Funds in return for payment, or ‘lending revenue’.

According to Sharegain it’s a $2.5tn market, but with over $40tn in assets currently sitting idle globally, the industry has significant potential for growth.

But the practice is not without its critics. According to the Financial Times (FT), Tesla boss Elon Musk called out securities lending for short selling borrowers of the tech company’s stock.

In an FT report, Mick McAteer, co-director of consumer rights research group The Financial Inclusion Centre, said individual investors looking at securities lending should be aware of the risks.

He explained: “Much fintech innovation is harmless if socially useless,” he said. “But from time to time there are ‘innovations’ that are clearly risky. Anyone using this would need to go into it with their eyes wide open.”

Sharegain’s $12m funding, secured across two rounds, came from venture capital firms Blumberg Capital, Target Global, Maverick Ventures Israel and Rhodium, along with a number of private investors.

The firm’s senior team has a combined 70 years’ experience in technology and finance. It is led by CEO and co-founder Boaz Yaari, whose 14-year background in capital markets includes time as a derivatives trader for a top-tier bank and portfolio manager at several European hedge funds.

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning London email for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East