Partner Article

From dial-up to distance-selling: How payments can keep you one step ahead of consumer needs

Who here remembers the sound of an internet dial-up?

That was the overture to any online shopping you did back in 2002. Although you probably weren’t doing much since another member of your household would have told you to stop hogging the landline. Anyway, online shopping was fiddly and time-consuming, you had no way of knowing what you were buying and you felt a bit funny about sending your card details into the ether.

Ecommerce had already been around for a while but not that many people were shopping online yet. Then SARS happened. Across China and Hong Kong, shops shut, schools closed, and people huddled in their homes waiting for the storm to blow over. Sound familiar?

While the impact of this epidemic was catastrophic, it sparked some important changes in consumer behaviour. Before SARS, internet penetration was still relatively low in China. But suddenly people needed ways of communicating, accessing information, and shopping from their homes. Internet adoption surged and ecommerce with it, signalling stratospheric growth for the likes of Alibaba and JD.com.

Almost two decades on, we’re in the throes of another crisis which is also accelerating the adoption of new technologies. Here’s a breakdown of some key shifts in consumer behaviour and how to stay on top of them:

#1: Contactless shopping with a personal touch

Contactless payments have become the payment embodiment of social distancing. They’ve been around since 1997 but in the last six months, adoption has soared. In April, Mastercard conducted a global study in which 82% of respondents said they view contactless as the cleaner way to pay, and 46% have swapped their top-of-wallet card for one that offers contactless.

Contactless payments are an essential tool when it comes to opening stores safely. But for many retailers, the challenge is how to offset the physical distance afforded by contactless payments with the delivery of a friendly, personal service. Here, the magic lies in the services which can be activated when your customer’s card is read by your payment terminal.

Traditionally, the disadvantage of the point of sale was that every customer was treated as a stranger unless they had a personal relationship with the sales staff. But now, if your online and in-store payment data is connected, you can offer all sorts of benefits, such as adding loyalty points directly to the customer’s card.

The Near Field Communication (NFC) technology that supports contactless cards can also be used to accept payments from mobile devices. So, if you accept contactless cards, you can accept the likes of Apple Pay and Google Pay™️ as well. Which brings us onto…

#2: The march of the wallet

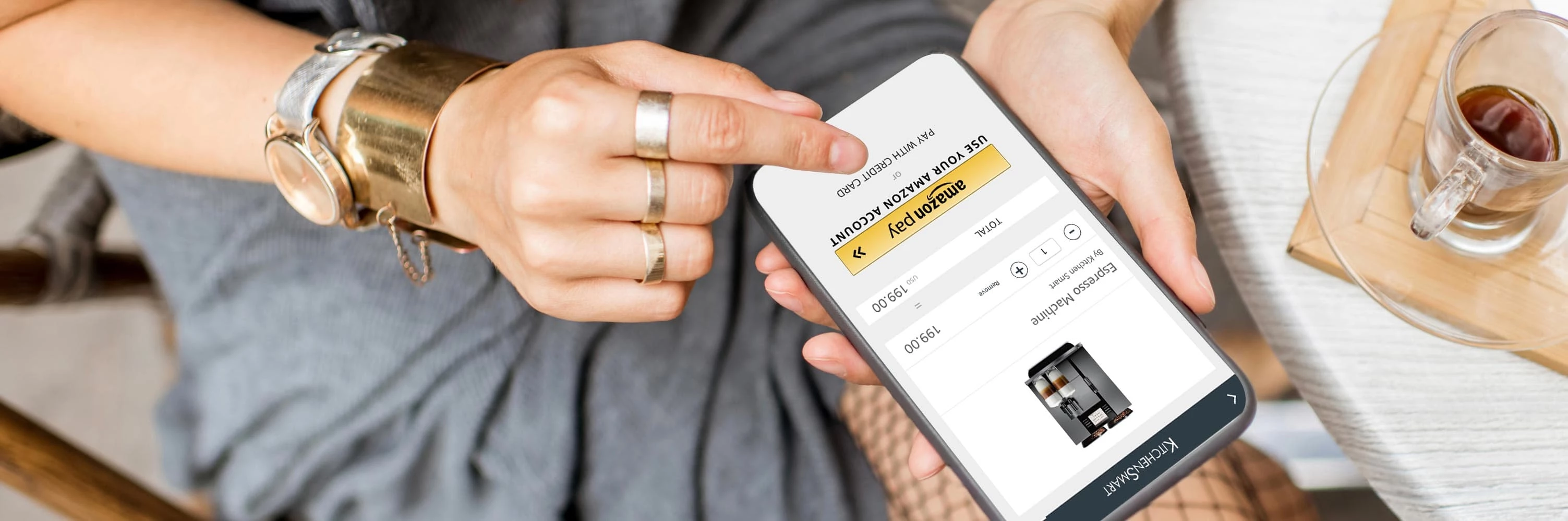

In a world where convenience rules supreme, anything that streamlines the payment process and helps drive conversions is greeted with a cheer. E-wallets are easy to use and secure. Apple Pay and Google Pay™️ have the added benefit of helping to blur the lines between online and in-store transactions so a shopper can move seamlessly between the two. And Amazon Pay lets customers pay online using information already stored in their Amazon account. In all cases, they remove the need to go digging around in your wallet, which reduces friction and helps increase conversions.

Back in January, Linker predicted that e-wallet penetration in the UK would grow by 18% year-on-year. Since then, the Adyen platform has seen an increase in wallet adoption, especially at the point of sale.

#3: The rise of the QR code payment

QR codes are popping up everywhere. From digital menus to shoppable window displays, it’s been heralded as a means of returning to ‘normal’ while maintaining your distance.

A QR code can also be used to trigger an ecommerce payment in-store. For example, the POS terminal generates a QR code which, when scanned, directs the shopper to an online payment page. From there, they can finish the payment as if it were a standard ecommerce transaction, complete with risk checks. This has the added benefit of not being restricted by transaction limits and so can be used to pay for items well above £45.

#4: Greater flexibility with payment links

Over the past few months, we’ve seen countless businesses turn to the payment link as a quick and simple solution to numerous pandemic-related issues.

Just as it sounds, the payment link directs shoppers to a payment page. In the days of closed call centres, payment links provide remote-working customer service agents with a secure means of processing payments. For example, jewellery retailer, Monica Vinader, uses payment links to sell to customers during live chat sessions.

Payment links have also been used to support distant-selling from stores. In-store staff notify regular shoppers of items in-stock and issue a payment link once a shopper is ready to buy. The items can then be delivered to the shopper’s home the same day, keeping contact to a minimum but still providing the instant gratification of an in-store experience. And, for in-store payments, payment links can be accessed via a QR code generated by the POS terminal, activating an ecommerce transaction as I mentioned above. In both cases, these transactions can be tracked as in-store purchases, so the store (and its staff) receive the credit for the sale.

Let’s make things clear

In a world where trading conditions change almost by the week, it’s impossible to plan with any degree of certainty. The best approach is to ensure you’re as nimble as possible so you can react fast whenever the next curveball comes along.

Of course, payments play just one part of a much more complex operational set-up and we can’t pretend that payments technology holds all the answers. However, a unified approach to managing your payments does give you greater flexibility. You can easily pivot to new sales channels, quickly roll-out new payments experiences, and view all customer data in one place. It won’t help you predict the future, but it will give you a clear picture of what’s going on right now.

By Colin Neil, SVP Business Development at Adyen UK

This was posted in Bdaily's Members' News section by SkyParlour .

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses