Leeds office building sold for £10 million

A landmark Leeds office building has been acquired in a multi-million-pound deal, signalling strong investor confidence in the city’s commercial property market.

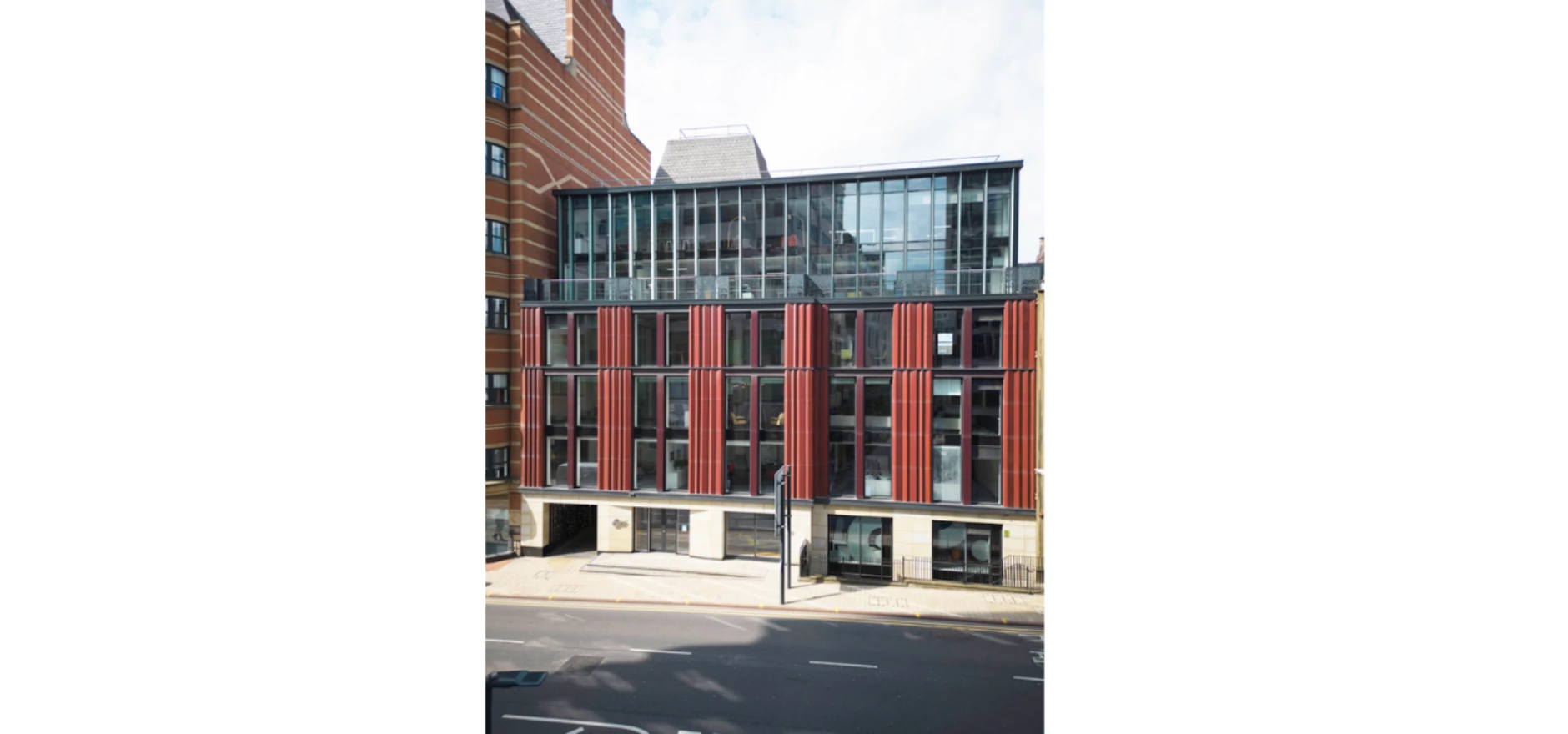

6 East Parade, a 44,000sq ft Grade A office space in central Leeds, was sold by Bridges Fund Management and Evenacre for over £10 million. The property was purchased by STR Capital on behalf of a private client, with Lewis Ellis advising on the transaction.

Marcus Langlands Pearse, partner at STR Capital, said: “6 East Parade follows on from our recent acquisition of 2 office buildings in Tunbridge Wells.

“Bridges have done an excellent job of repositioning this Leeds City Centre office and we look forward to further enhancing the space.

“6 East Parade complements our current strategy of buying well let, future proofed buildings in strong locations.”

The prominent seven-floor building, which includes 13 basement parking spaces, is multi-let to a diverse list of tenants including Dentsu, DLA Architects, Claranet, Iwoca, Muse, Overbury and ABS Limited.

Alex Whiting, senior director at CBRE, who advised Bridges and Evenacre, added: “6 East Parade is a high-quality refurbished building in a prime location and investor interest in the property was strong.

“This multi-million-pound deal highlights the continuing improvement of the Leeds investment market.”

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular Yorkshire & The Humber morning email for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East