Partner Article

Leeds’ Toronto Square acquired for £29m

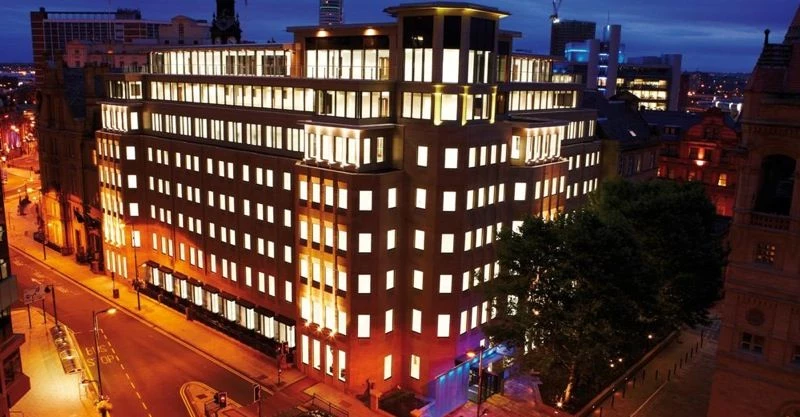

Toronto Square, a grade A office development in Leeds, has been purchased by the M&G Property Portfolio fund in a £29m deal with Highcross.

The 88,200 sq ft property in central Leeds, which has a BREEAM rating of Excellent, was developed in 2010 and is multi-let to fourteen tenants.

Commenting on the deal, Justin Upton, deputy fund manager of the M&G Property Portfolio, said: “There is always strong tenant demand for high quality office developments such as this and, with corporate occupiers becoming more demanding in their requirements, this acquisition provides the Fund with an attractive income yield of 7% and further opportunities to drive performance via the implementation of asset management initiatives.

“The acquisition reflects the Fund’s continued commitment to acquire high quality grade A offices in core UK cities.”

Richard Pellatt, director at Highcross said: “This sale marks the successful completion of our business plan for Toronto Square.

“During Highcross’ ownership we have completely redeveloped the property, remodelled the entrance, extended the floorplate and added two storeys to bring the building up to a grade A standard.

“Testament to its quality, the building has secured fourteen new tenants in challenging times and is now well placed to benefit from future rental growth in an increasingly tight Leeds city centre market.”

The M&G Property Portfolio is managed by Fiona Rowley and Justin Upton of M&G Real Estate.

Knight Frank represented M&G Real Estate, the real estate investment management arm of M&G Investments and Highcross was advised by CBRE, which is a tenant at the Toronto Square building.

This was posted in Bdaily's Members' News section by Mark Lane .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular Yorkshire & The Humber morning email for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East