Partner Article

Are you ready for a resource crunch?

As I write, the big UK energy companies are hiking their gas and electric prices to an outpouring of anger and despair from all quarters. A political debate has raged over whether the blame lies with energy fat cats’ profiteering or green taxation, but neither has as much impact on consumer prices than the rising cost of the energy itself.

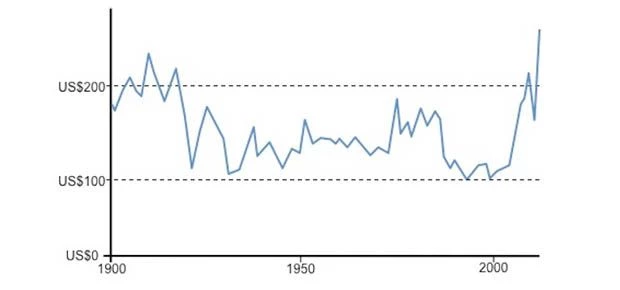

It’s not just energy either. If you look at the long term MGI Commodity Price Index (above) which combines energy, agricultural products, food and minerals, you will see we live in strange times. Prices spent the 20th Century falling, except for moderate rises due to major traumas such as two World Wars and the 70s Oil Shock, but at the turn of the millennium they suddenly started shooting back upwards, wiping out the fall of the previous 100 years. The banking meltdown of 2007/8 appears as just a blip. The shale gas boom in the US appears to have done nothing to restrain the surge.

It is no surprise then that nearly a third of profit warnings by FTSE 350 companies in 2011 were attributed to rising resource prices. A recent survey by the manufacturers’ organisation EEF found 80% of senior manufacturing executives thought limited access to raw materials was already a business risk. For one in three it was their top risk. While we might think we are far from a dystopian Mad Max-style societal breakdown, it has been estimated that about 20 wars have been fuelled by resource scarcity in the last 50 years.

So what does this mean for business? As always there is risk and opportunity.

The risk is that soaring commodity prices will squeeze your business or your customers, or that your customers will switch to alternative suppliers. The latter is no joke – big purchasers such as the public sector, retailers and major brands are driving sustainability down through their supply chains. For their suppliers it’s often a case of ‘go green or go bust’.

The opportunities lie in solving the problem – and the solution is in front of our noses. The natural world copes with finite resources by cycling them in continuous loops (the carbon cycle etc) using renewable energy. Likewise we need to shift from our largely linear take-make-waste economy to a circular economy and reap the free bounty of energy provided by the sun. This in turn creates a huge number of business opportunities – resource recovery, renewable energy, electric vehicles, control systems, smart grids and all the associated services such as training, maintenance and legal advice. These are already being exploited by quick thinking entrepreneurial companies - a third of all growth in the UK economy last year was in the ‘green’ sector.

Whether you need to act to avoid the risks or grasp the opportunities, or both, one thing is for sure – business as usual is not an option.

This was posted in Bdaily's Members' News section by Gareth Kane .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning National email for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East