Partner Article

Is London overvalued?

The UK Property Market has always had a strong focus on the capital city, with many investors in the past choosing to pool their money into properties in the London area. However, in yesterday’s report by Nabarro, research suggests that interest in regional investment property is quickly increasing. City regions such as Birmingham, Leeds and Manchester are now attracting the attention of those looking for “better future returns” “where employment is strong and yields are growing.” In the same report, based on a survey of 239 property investors, developers and agents collectively controlling £150 billion, the results concluded that 42% agreed that Birmingham is one of the most appealing regional cities, placing it second on the list behind Manchester. Interest is steering towards regional investment because of its increasing strength and security in comparison to London, which 47% of those surveyed agreed was over-valued.

Not only is this encouraging residential property investors to consider areas outside of the capital, but institutional investors are also looking to expand their horizons and move out to other regions in the UK. While their usual investment strategy has been placed into retail or commercial property in the past, they are now discovering the merits of investing into the private-rented sector.

“Excluding London and the South East, UK house prices increased by 6.3% in the 12 months to April 2014”, and Savills 5 year forecasts for each individual region show the potential growth that investors can expect from their properties. Birmingham has hopes for a rise of 23.4% by 2018, Leeds is hoping for a rise of 20.5% by 2018 and Liverpool and Nottingham are looking at 19.3% and 24.6% respectively. These price rises could potentially help to fuel construction within the UK, and recent data from Nationwide has shown that the construction sector grew in June at its fastest annual pace in four months.

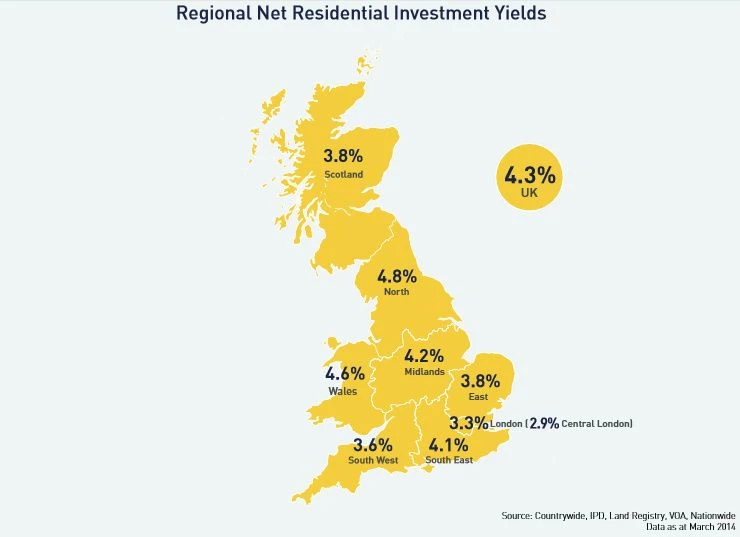

It is incredibly positive and exciting for the UK Property Market that 86% of those surveyed in Nabarro’s poll “think that the attractiveness of regional property will increase over the next 2 years.” Impressive yields, as illustrated in the above image from Cushman & Wakefield, make for excellent returns on investments, so it is not surprising that interest is shifting away from the capital city.

We have a range of properties located in regional areas of the UK, outside of London. For more information, please contact one of our Sales Consultants on 0113 380 8930 or alternatively email info@emergingrealestate.com

Sources

Property Wire, Nabarro, Savills, Reuters, Infographic sourced from Cushman & Wakefield’s Residential Aggregator.

This was posted in Bdaily's Members' News section by ERE Property .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning National email for free.

The value of using data like a Premier League club

The value of using data like a Premier League club

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector