Partner Article

Tait Walker help Washington firm reel in tax credits

North East-based accountancy firm Tait Walker’s R&D tax reliefs specialists have successfully reclaimed over £11m of cash back in tax rebates for North East businesses since 2011.

Led by tax partner Alastair Wilson, Tait Walker’s specialist team has successfully submitted more than 200 claims over the past two years, with a 100% success rate and helping North East companies identify over £55m of qualifying R&D expenditure, in respect of which tax relief could be obtained.

With the largest single claim generating a tax repayment of over £0.5m and a total of over £1.5m secured for a single group, larger scale projects have involved claiming tax reliefs on water utility improvements for the London Olympics, power generation systems in the Caribbean and software development on a computer game – which went on to win the TIGA 2013 Game of the Year.

Tait Walker tax partner Alastair Wilson said: “The variety of research claims is incredibly diverse in this role – you can never predict what type of clients you’ll be assisting. We’ve worked on everything from a safer hyperbaric toilet to an aerobic compost bin and ecologically greener paving slabs.”

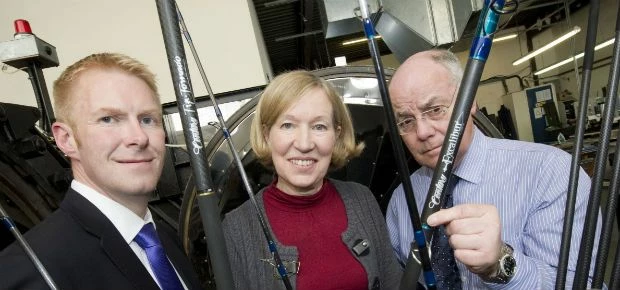

One such firm to benefit is Washington based Century Composites, manufacturers of market-leading carbon fibre fishing rods.

Century Composites’ Vicky Chilcott said: “We have built our business on having the most current and state-of-the-art technology to help develop our high-specification fishing products. We are now in our fourth decade of investment into research and design to allow us to continue manufacturing some of the finest fishing tackle in the UK.

“Without Tait Walker’s help to claim R&D tax credits the most recent investment wouldn’t have been possible. The opportunities the additional funding has presented us with are considerable and I’d urge any business, whatever their area of expertise, to consider what benefits securing these tax credits might bring for their company, both in the short and long term.”

Alastair added: “The UK’s R&D tax relief programme provides £1bn of funding across the UK annually and adds about £18m of additional funding to the North East economy each year, of which we typically generate about £5m a year for our clients.

“We have clients for whom it has generated cash windfalls which have either enabled them to invest in new equipment when traditional funders wouldn’t lend to them, to recruit or simply retain key staff.

“In 2014, we will seek to continue growing our team as we develop our Intellectual Property Tax Reliefs group covering R&D claims, Patent Box claims, Creative Sector Tax Relief claims as a specialist department advising companies on how to develop the value they derive from their intellectual property.”

This was posted in Bdaily's Members' News section by Ellen Forster .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our daily bulletin, sent to your inbox, for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East