Partner Article

Late filing fees scrapped by HMRC

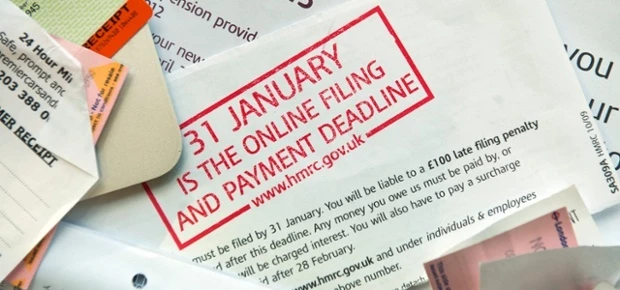

Hundreds of taxpayers who missed the deadline for 2013/14 self assessment returns will no longer be hit with a £100 fine for late filing, provided they have filed an appeal on time and included a reasonable excuse for lateness,“ says McLintocks Director, Caroline Blake.

“HMRC has relaxed its conditions for accepting appeals against late filing penalties for 2013/14 self assessment tax returns,” said Caroline of the Chester based accountancy firm.

She explained: “The change in practice was confirmed on 5 June when it became clear that HMRC did not have sufficient resources to check in detail every reasonable excuse offered for a late tax return. HMRC will now accept excuses made on appeal for late self assessment tax returns at face value providing certain conditions are met. These conditions are that the penalty must relate to the late filing of a 2013/14 self assessment return; the return for 2013/14 must now have been received by HMRC; and the tax due on that return must have been paid. If this is the case, the appellant will not have to pay late filing penalties.”

Delays in filing can be for a number of reasons: computer failure, service issues with HMRC online or postal delays. No more appeals for 2013/14 are now being accepted by HMRC as the 30 day period has closed. Anyone requiring advice or assistance on this matter is welcome to contact Caroline on 01244 680780.

This was posted in Bdaily's Members' News section by Joanna Dakin .

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East