FinTech startup promises zero mark-up FX

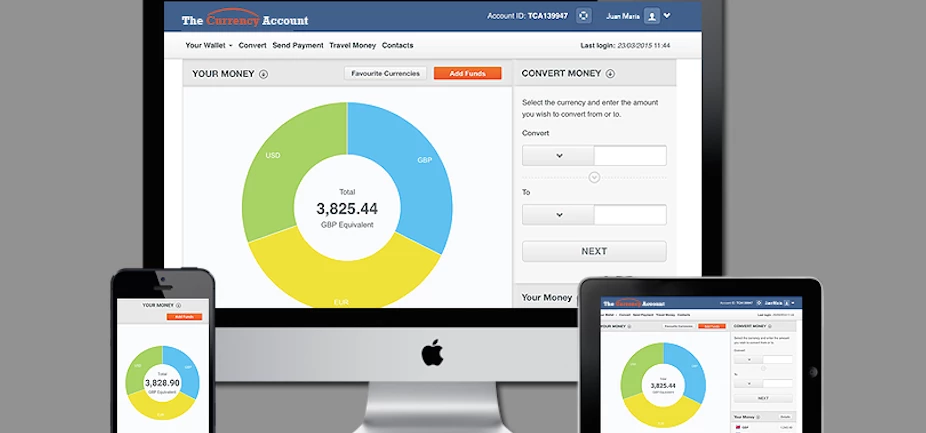

The Currency Account is a new FinTech start-up that promises to remove the anomalies when it comes to foreign exchange for consumers and businesses. Today, the company has launched a new, highly competitive, online currency exchange service – a user friendly customer portal provides a fast and very efficient way to arrange delivery of travel cash and make international payments.

The currency exchange market has seen recent change – the Banks and Brokers who dominate the sector are renowned for their high charges and cumbersome procedures and a number of new operators have sought to challenge that monopoly by offering bespoke services at reduced cost. The Currency Account takes this process of change to its logical conclusion.

The concept of ‘Peer to Peer’ transactions, cutting out the middlemen and their costs, by matching buyers and sellers has been a fashionable model for newcomers to this sector but it is limited in that matching cannot be guaranteed instantly, transaction delays are common and exact exchange rate are rarely certain.

The Currency Account offers all users the “highest level” of access to the currency exchange network. There is no minimum amount of money that you have to deposit. You can go ahead and purchase €1 if you want – you still get the same ‘true’ market rate with zero mark-up. All users are treated the same and the cost is a simple, transparent fee per transaction. The service combines the best of all worlds – it provides the user with all the advantages of Peer to Peer exchange rates but there is no need to wait for a match as there is always a buyer available for every seller.

With The Currency Account service being available to individuals and businesses there is a real alternative to the use of Banks for everyday currency transactions – as the name implies the customer has a “currency account” – one account – that can store multiple currencies and convert one from another and remit funds overseas or withdraw currency for travel purposes.

As a new provider The Currency Account is pledged to progressively increase the range of its services to embrace the constantly widening use of new technologies and meet all the modern needs of its customers. A fully integrated Visa and MasterCard will soon be available to all users and mobile payments are high on the agenda.

“There is an unbundling of the financial services industry that’s occurring right now, and we see an enormous opportunity to provide advanced, more efficient solutions across the foreign exchange sector” says Rishi Patel, CEO of The Currency Account.

Rishi says “In a few years from now we will be wondering why we were ever paying up to 5% for currency exchange!”

This was posted in Bdaily's Members' News section by Rishi Patel .

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses