Partner Article

Something about foreign market

Forex trading, or fx trading as it is also being called, is becoming more and more popular among retail traders. The recent years saw the fx trading growing in popularity and this was due to the fact that Internet has become worldwide available and therefore online trading a reality.

Everyone wants to earn extra money doing another activity on their free time and forex trading seems to be the perfect one. Trading the forex market implies having access to the objects that make the forex market, or the currency pairs.

Such currency pairs are not the only products a broker like BRAND, and as a matter of fact all brokers, are offering. On top of currencies, a broker offers also commodities like gold, oil, silver, etc., indices like FTSE, Dow Jones, etc. and CFD’s (Contracts for Difference).

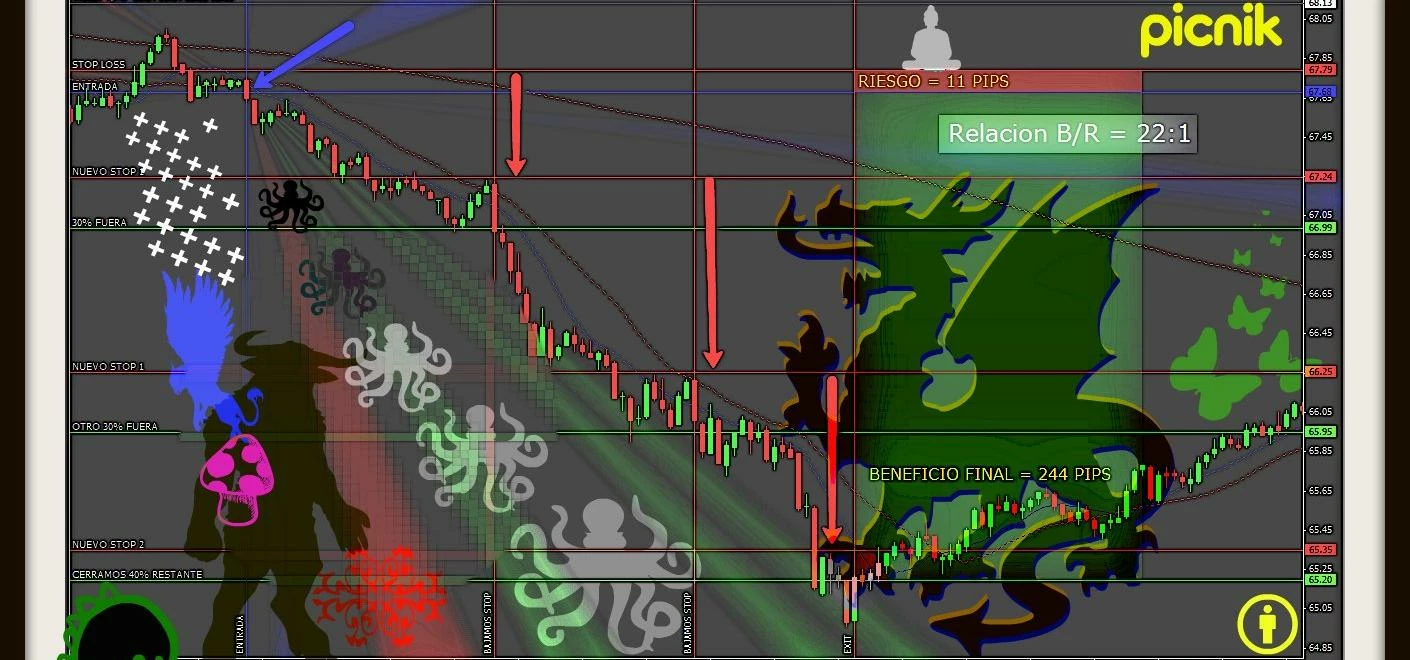

The principle is the same though as the one used for fx trading: finding a place to go long or short and if the market is moving in the indicated direction, a profit can be made based on the difference between the entry and the exit prices.

The forex market is the most liquid market in the world and traders from all over the world are exchanging currencies on a daily basis. The total turnover, or volume, is over five trillions in a single day and the popularity of the fx trading can be explained by the fact that currencies tend to move quite fast and this attracts traders and quick profits can be made.

When compared with other markets, the forex market has the advantage of being extremely liquid. It means that selling or buying even in high volumes, on the forex market, is not going to be visible at all.

The overall forex market is being made up by many entities, not only retail traders. Actually, retail traders represent only five percent of the overall volume traded on the forex market.

The rest is being made up by institutional companies, commercial and central banks, and even other forex brokers. They all are active parties on the interbank market and they make up for all the volume that represents fx trading.

Some options from the regular options market are influencing the fx trading as well. These options expire on the third week of every month and these so-called forex options are the cause for prices fluctuating around fixing times.

In order to offer the best possible prices to forex traders, a broker is using different liquidity providers for this. As a rule of thumb, the more liquidity providers being used, the better the quotes used in fx trading will be.

When opening a trading account, there’s a risk disclaimer that the retail trader is forced to take into account. Such a risk disclaimer has the purpose of warning traders that markets are moving really fast and losses can exceed the amount in a trading account.

This is due to the fact that forex trading is a leveraged one and all open trades are leveraged. This is the only way for a retail trader to take part on the overall fx market as otherwise is not possible to trade with small amounts of money.

A stop loss is not mandatory to be executed as well if there is no market for it. The broker guarantees an execution is there is a market but what happens if there’s no market?

Such a situation took place when the Swiss National Bank (SNB) decided to remove the floor on the EURCHF. The EURCHF cross has been pegged for years to the 1.20 level and many traders bought the pair with a stop loss just below the 1.20.

However, the decision to drop the peg resulted in the market collapsing all the way below 0.87 and that is where a market could have been found. Brokers were not able to fill the stop orders as there was no market!

Nevertheless, fx trading is popular as each and every trader can set up its own trading style. Traders oriented on short-term profiting are being scalpers. They use short to very short-term techniques, usually based on technical indicators, to trade the forex market on the lower time frames: five minutes’ chart and even the one minute one.

Other traders are being called swing traders as they analyze markets from a different perspective and keep trades open for a longer period of time, like days or even more than a week. These traders use Elliott Waves or other trading theories on the bigger time frames in order to come up with the entries and exist for their trades.

Last but not least, there are traders that look only at the bigger picture, like weekly and monthly charts and are not interested in the short-term horizon. What these traders do is they look at the charts when markets are closed, over the weekend, and set pending orders, take profit and entry and exit levels.

This way, it is fairly easy to trade and be involved in fx trading while doing other things you like in life, or even keeping a regular job. There’s no need to put in the screen hours or to monitor markets, nor the economic events will mean nothing for this category of traders. These are called investors.

Investors that participate in the fx trading are taking their position from a fundamental point of view as well. This means that based on a specific divergence of monetary policy between two major central banks, one can decide to trade a specific currency with no time horizon in mind.

All the things listed here have the purpose of offering some generalities for the forex traders that are involved in this market, starting with other participants and ending with details regarding how this market functions.

SUMMARY Forex trading implies taking a long or short position (buying or selling) on a currency pair in anticipation of a future movement a currency pair is about to do. For this, traders open a forex trading account with a broker.

This was posted in Bdaily's Members' News section by Dwayne Buzzell .

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East