Partner Article

Next Generation Platform for the Insurance Industry

Data is transforming the way we live our lives. It is reshaping the businesses that we build, work for, work with, and use, across many different facets of society and the economy.

Take transportation. From Tesla to Mobileye, Uber to Gett, we are seeing a rapid proliferation of data-driven technologies that bring positive changes to the way we’ve previously approached transport - from preventing collisions and saving lives, to reducing fuel costs and lowering carbon emissions.

In the cognitive era, those businesses with the best data sets win. The car insurance industry, however, has lagged behind other sectors when embracing digital technologies. As a consumer, our options for insurance remain limited by what insurers know about us and have historically sold to us.

But our expectations are now changing. Millennials have grown up with digital technology and expect services that specifically cater to their behaviours, and are now beginning to question why technology is not showing up in their insurance.

And it isn’t for a lack of data. Experts predict that by 2020, connected cars alone will collect more than 11 petabytes of data a year, including from embedded telematics devices. To put this in context, 11 petabytes of songs playing continuously would last for over 22,000 years, assuming the average MP3 encoding for mobile is around 1MB per minute, and the average song lasts about four minutes.

It’s just that data from different hardware and software sources hasn’t been housed in a usable platform before.

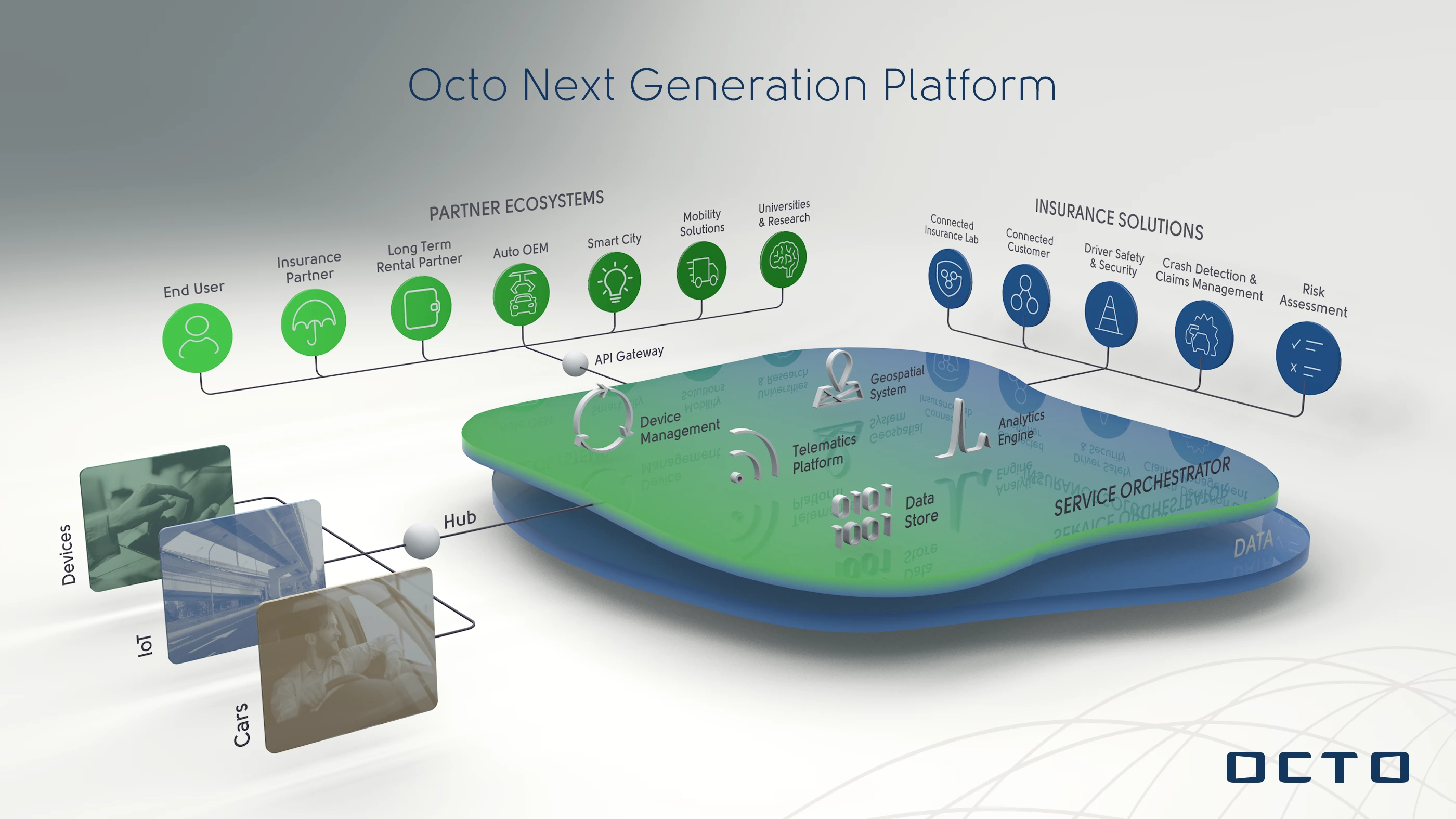

It is for exactly this reason that Octo is launching NGP - a platform akin to an app store for auto and insurance innovators. Its “plug in and play” system allows for the gathering and sharing of data from a multitude of sources (e.g. whether an autonomous car sensor, a mobile phone or a telematics ‘black box’) to accelerate the development of autonomous cars and enable innovation of new auto/insurance products and services, to ultimately make the experience of securing car insurance both slicker and cheaper.

Start-ups have a readymade infrastructure on which to build their new design, giving them access to a wealth of data and analysis, as well as sharing the pond with many large insurers, which are already seeing this as a way of revolutionising their own clunky systems.

This has a direct influence on something that data capture makes truly measurable: risk. Currently, insurers have to price their policies based on static data and historical assumption; the risk premium of an insurance, for example, is currently determined by the driver’s age or the model of car they own, regardless of their actual driving behaviour. However, by harnessing driver data and applying sophisticated data analytics, companies like Octo Telematics can give insurers the insights they need to forecast individual risk.

The total value of auto telematics powered insurance premiums alone is expected to reach $67bn by 2020. The NGP is ready for the age of connected insurance primarily for the car insurance market, but home and health insurance is also a large area of growth. As IoT expands into homes, drones, wearables and even into our pets, this modular approach will play an increasingly important role. Connected insurers means connected consumers, connected cars, and connected homes.

Like the travel and media industry before it, insurance is going through its own transition into digital. This will ultimately allow insurers to have a stronger relationship with customers as interactions will no-longer be limited to an annual basis, with data and new tools giving both parties regular touch points throughout the year.

Equally, it will give customers the opportunity to have tailored insurance policies that meet their personal needs and expectations.

The Cognitive Era is set to change and support our lives wherever data capture happens. As the Internet of Things spreads, everyday objects will soon be defined by the sophistication of the algorithms powering them. And customers, manufacturers and service providers will have to rely on companies skilled in secure data analytics to extract the data and provide the information needed for rapid insight and action.

Most of us still see the computerisation of our cars as being about driving convenience and fun. But that will be just one aspect of the transformation. Thanks to the Algorithm Economy, driving will also be cheaper, safer, and an integral part of the Internet of Things.

This was posted in Bdaily's Members' News section by Jonathan Hewett .

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses