Partner Article

Growth in Irish Residential Property Market Presents Opportunities for Lotus Investment Group - Chairman David Grin

The increasing demand for housing and continued growth trends in the residential property market in Ireland have created a unique opportunity for alternative property funding firm Lotus Investment Group, led by Chairman David Grin.

The Marketing Institute of Ireland and UCD Michael Smurfit Graduate Business School recently released the final quarterly report for 2018 of the Consumer Market Monitor (CMM). The report offers insights into trends in consumer behavior in Ireland, highlighting emerging opportunities for planning and investment. It has a positive outlook for the next two years, with favorable economic conditions expected to remain strong, alongside anticipated population growth and rising employment rates. Brexit remains an issue for consumer confidence, but government development planning is intended to assuage economic fears.

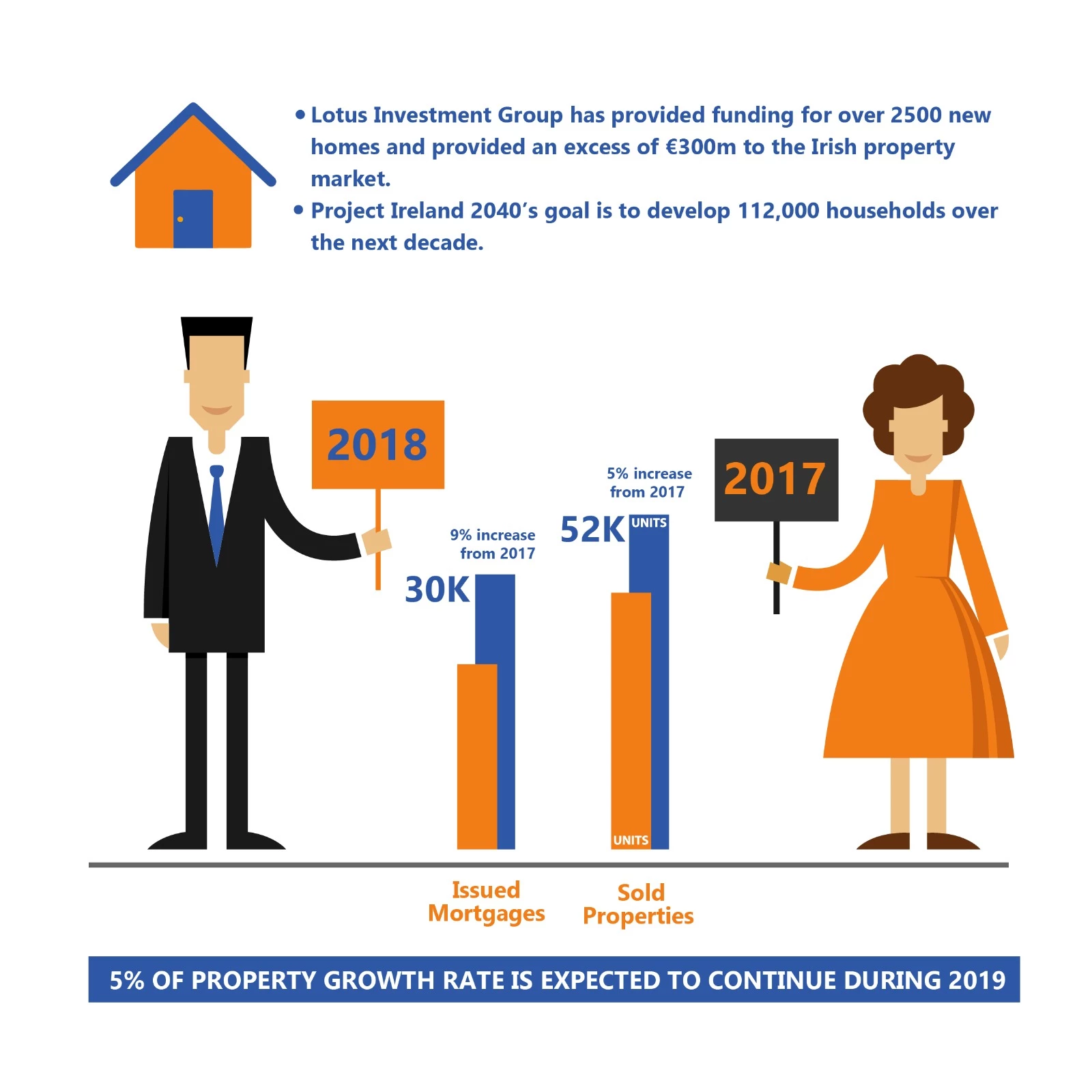

Growth Trends in the Irish Property Market The Marketing Institute report reveals steady growth in Ireland’s residential property market. The market has continued to recover from its lowest point in 2011, when just 25,700 properties were sold, and 10,500 mortgages were granted. In 2018, 52,000 properties were sold, a 5% increase on the previous year, and 30,629 mortgages were granted, marking a 9% increase on 2017 loans. This growth trend is expected to continue through 2019 and 2020. However, it remains a far cry from the boom year of 2005 when 105,000 homes were sold, and 85,000 mortgages were approved.

Employment is continuing to rise, rivalling pre-recession levels, however, even with steadily increasing mortgage lending rates, Ireland has yet to achieve the property boom experienced in 2005. While analysts must be cautious when comparing pre- and post-recession mortgage conditions, the disparity in mortgage financing reveals an underutilization of property funding by consumers and a potential niche market for mortgage lenders willing to transcend the traditional financing model.

With mortgage lending continuing to grow, and mortgage conditions continuing to adapt to the demands of the market, an excellent opportunity has emerged for flexible mortgage lenders like Lotus Investment Group. Lotus specializes in alternative property investments based on durable partnerships with developers. The advantage over traditional lenders is the ability to provide fast and flexible funding solutions. To date, Lotus Investment Group has funded over 2,500 new homes and contributed in excess of €300 million to the Irish property market.

Disparity Between Housing Supply and Demand Forecasts suggest that sales will increase by a further 5% this year, a modest rate of growth that is at odds with the high level of demand driving up national rent and purchase prices. The continuing trend of disparity between strong demand and weak supply is stimulating construction throughout the country. A growing population, changing social demographics in an aging population, smaller family size, and continued urbanization has led to a shift in demand for urban residences. In accordance with these changes, first time home buyers are the largest group of mortgage recipients, accounting for 60% of the mortgages granted, and the emerging private rental sector is set to grow at an unprecedented rate.

In a property market where demand outstrips supply, Lotus Investment Group provides a fundamental role in driving new construction. After entering the Irish property market in 2013, Lotus has quickly become the go-to firm for property investors and developers. Their client specific funding model allows Lotus to quickly respond to funding demands, ensuring development projects proceed without delay.

Urban Growth Forecast In 2018, the Irish government published Project Ireland 2040, a strategic development plan aimed at promoting sustainable growth in the anticipation of dramatic population increase. To meet the needs of population growth and to remedy the current shortage in housing, Project Ireland 2040 prioritises compact urban growth over unplanned urban sprawl. The government is encouraging developers to build up existing areas, and to increase the height of commercial and residential buildings. To achieve this urban expansion, the state will commit to a €2 billion Urban Regeneration and Development Fund encouraging a collaborative effort between the government and the private sector. The goal is to reach 112,000 households over the next decade, with 30% of these homes built in urban areas.

According to Chairman of Lotus Investment Group David Grin, “Continuing growth trends in residential property planning and construction provides an exciting opportunity for investors and developers. The market will be forced to evolve to meet the predicted shifts in demand. We believe that our innovative, flexible investment model provides Lotus Investment Group with a distinct advantage in the dynamic Irish property market.”

With the current and planned new high-rise, mixed-use development projects, and an emphasis on four to six story residential construction, the innovative funding solutions provided by Lotus Investment Group will continue to be in high demand. The firm’s focus on providing financing to new residential development of small to medium property assets is directly in line with the strategic development plan published by the Irish government.

Technology in the Real Estate Sector Technology in the commercial real estate sector is also transforming the way consumers interact with the industry. The revolutionary ‘proptech’ sector, the collective term used to describe technology designed for planning, construction, and property, offers realtors, investors, developers and home buyers innovative solutions and drives growth at an unprecedented rate. The new Irish online bidding platform, Beagel.io, surpassed €100 million in online bids for Irish properties in recent months. It is yet to be seen if the industry will be able to adapt quickly to keep pace with the new technologies available.

Innovative technology applied to mortgage lending and investments has the potential to accelerate the process of planning, development, and construction. From its inception, Lotus Investment Group has embraced this fast-paced approach to lending as a way of conducting business. With the flexibility afforded by the alternative financing model of Lotus Investment Group, clients have an advantage over the barriers experienced in the traditional bank funding model. Continuing to promote innovate funding and investment strategies raises the standard of service that Lotus Investment Group is able to provide for its clients.

This was posted in Bdaily's Members' News section by James Lawren .

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East