Partner Article

Help is here for UK businesses to maximise digital sales conversions during COVID and beyond

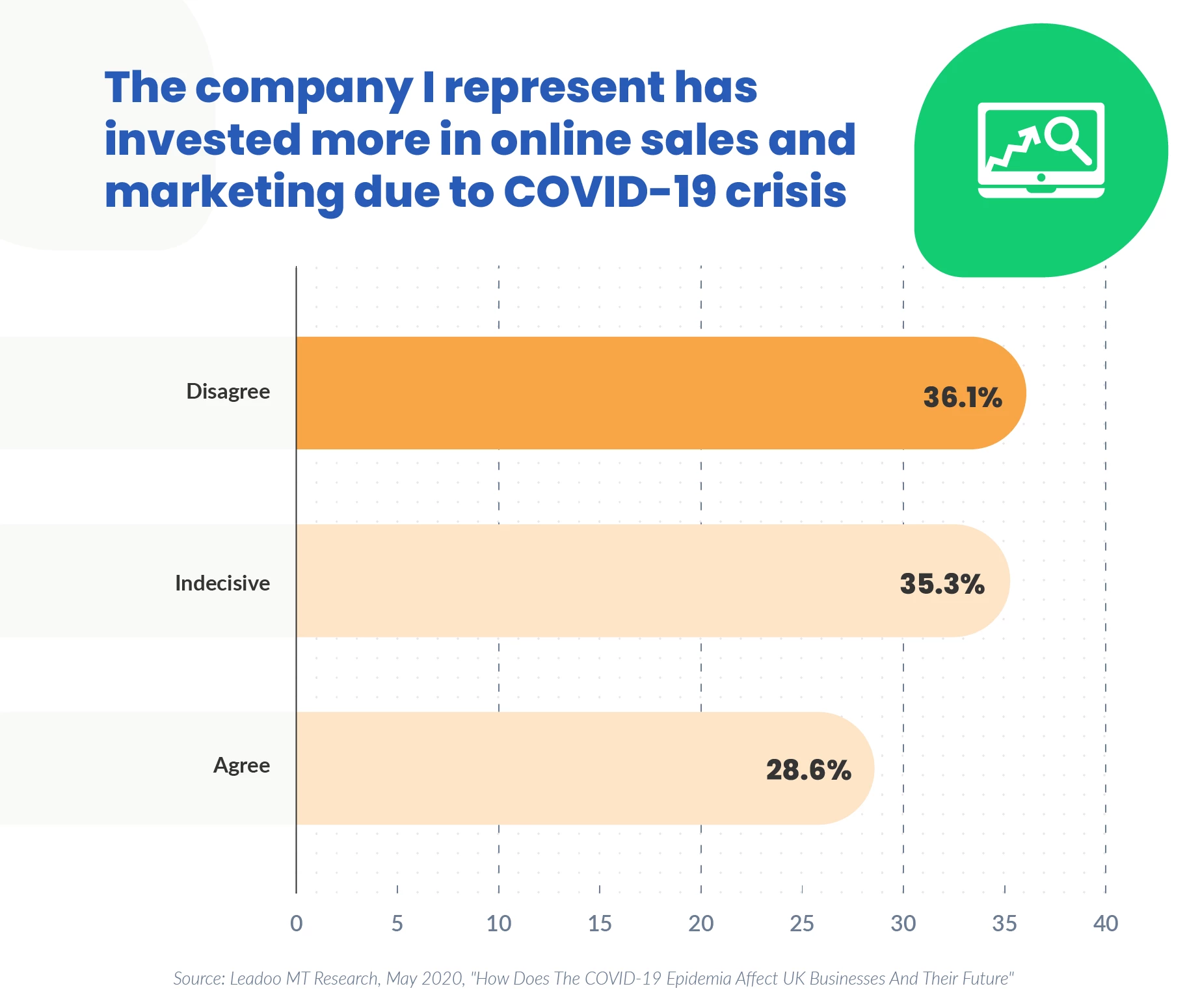

Research shows that less than a third of UK businesses have invested more in digital sales and marketing during the coronavirus crisis despite less than half being ready to serve customers digitally at the start of lockdown.

Mikael da Costa, Founder of Leadoo Marketing Technologies, the never miss a lead again conversational lead generation marketing technology company which has launched a new platform to help UK small and medium enterprises update their marketing strategy, fight back in the current business climate and set themselves up for future proofing their business said: We have been seeing unprecedented interest in our services from businesses wanting to make the most of their digital business and engagement opportunities in the absence of face-to-face opportunities. This is a tough time for small and medium businesses, almost without exception they need more leads and more sales. They now need to make their websites work much harder for them to generate business and make these digital improvements at speed.

To accompany the introduction of its new conversational lead generation platform, Mikael released the results of a survey amongst UK businesses with a snapshot of highlights:

- Only a third of UK businesses have invested more in digital sales and marketing during the COVID crisis.

- Construction and transport lagged the furthest behind when it came to upping investment in their sales and marketing, with just 15% saying they had compared to 59% of tech companies, the sector which increased investment in digital sales and marketing the most

- Regionally, companies from the East of England were the most hesitant to invest in digital sales and marketing with just over half saying the Covid-19 crisis had not led to any increased investment, whereas it was London and the South East and the South West who indicated the highest level of investment in digital sales and marketing).

- Business size also had an impact on how likely the business was to up its digital investment with small companies most hesitant as only a quarter agreed that they had invested more due to the crisis compared to a third of large companies.

- Half of businesses stated they have taken action to make their business more digital due to Covid-19.

- Business services led the way in taking action to make their business more digital at two thirds, followed by financial services at 62% but only a quarter of construction companies.

- Owners/partners are less satisfied than their employees with the actions taken by their company in order to survive the crisis. They also considered their business to be less prepared for the crisis than they had previously thought.

- The East of England lags behind particularly with only a third thinking they have taken sufficient action in making their business more digital due to the crisis.

- Only just over a third of people working for or owning a small company think they have taken action toward making their business more digital due to the Covid-19 crisis.

- Just over half of companies agreed that having been forced to be more virtual, it would change the way their company does business in the future, with this peaking at just over three quarters for those in business services. Companies in London and the South East as well as the South West were more likely to see the Covid crisis as something that will change the way of doing business in the future.

Commenting on the research, particularly the differences between small and large companies where only a quarter of small companies have invested in digital sales and marketing vs a third of large, founder of The Marketing Meetup Joe Glover said: It’s really interesting to see the split here, with the largest clusters being at the extreme ends of investment. My view is that companies should be looking to invest now, where possible. Prices to gain share of voice have decreased, meaning you’re now getting more bang for your buck in terms of exposure.

Glover continues: However, expectations also need to change: while you will gain voice and brand awareness in the current climate, I would also not expect to see huge jumps in purchases right now, simply as folks will be saving what they have rather than freely spending. The play here, therefore, is a long term one: gain voice now, convert more later. There are, of course, exceptions to this rule. I’ve seen some companies who have directly felt the benefit from the crisis and seen sales skyrocket. In these industries, the pre-COVID rules apply even more: invest or get left behind. All this is backed up by historic data: more important than just the COVID crisis is the likely recession we will find ourselves in. In previous recessions, the big winners have been those who have invested throughout. Of course, investing represents the ideal. As a business owner, I know this is hard: cash flow is tight: you have to do what you can to survive, but right now - I’m looking to suggest people to invest.

da Costa continues; People have not and will not stop spending, but companies need to be ready to handle this digital engagement. The UK market is particularly responsive to a conversational lead generation approach and we see increases of inbound leads of between 50-100% for UK companies . da Costa therefore warns that those small and medium enterprises that continue not to focus on making their business more digital will find this inactivity backfiring post COVID-19 as how buyers behave has changed for good.

The research showed that smaller companies have taken least action in adapting to the crisis, have not invested in digital sales and marketing, do not seem to view this crisis as changing the way they will operate in the future and are more unhappy with actions taken by the government to help. Commenting on this research, da Costa says: We were surprised as we thought perhaps smaller companies would have been more agile than the larger companies but it seems they are not adapting well. Whilst we would not expect them to invest to the same extent as medium or large companies, we think this lack of action will harm their prospects going forward.

This was posted in Bdaily's Members' News section by Mike Smith .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning National email for free.

The value of using data like a Premier League club

The value of using data like a Premier League club

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector