Partner Article

Younger shoppers opting to Buy Now Pay Later on Black Friday this year - new research

UK shoppers are planning to hunt for energy-saving bargains, including blankets and small space heaters, on Black Friday this year. According to new research announced today by quantilope, more than a quarter (28%) of shoppers plan to buy products to help save on their energy bills this winter, while a third (34%) will look for basic essentials for themselves or their family.

Alex Hall, Associate Director at quantilope, believes that shoppers are looking to Black Friday as a way of saving money in more ways than one. “It’s a time when people usually look for deals on gifts for themselves and their families ahead of Christmas. While this still holds true this year, we’re also seeing substantial metrics for those stocking up on basic essentials, items for the household, and even energy-reducing items. This might signal the start of a changed perception about Black Friday.”

quantilope surveyed 400 consumers in the UK (and 400 in the US) to understand more about their Black Friday shopping habits and how they plan to pay for their purchases.

The rising cost of living is clearly having a big impact, with a quarter of those abstaining from shopping saying that inflation has affected their discretionary spending.

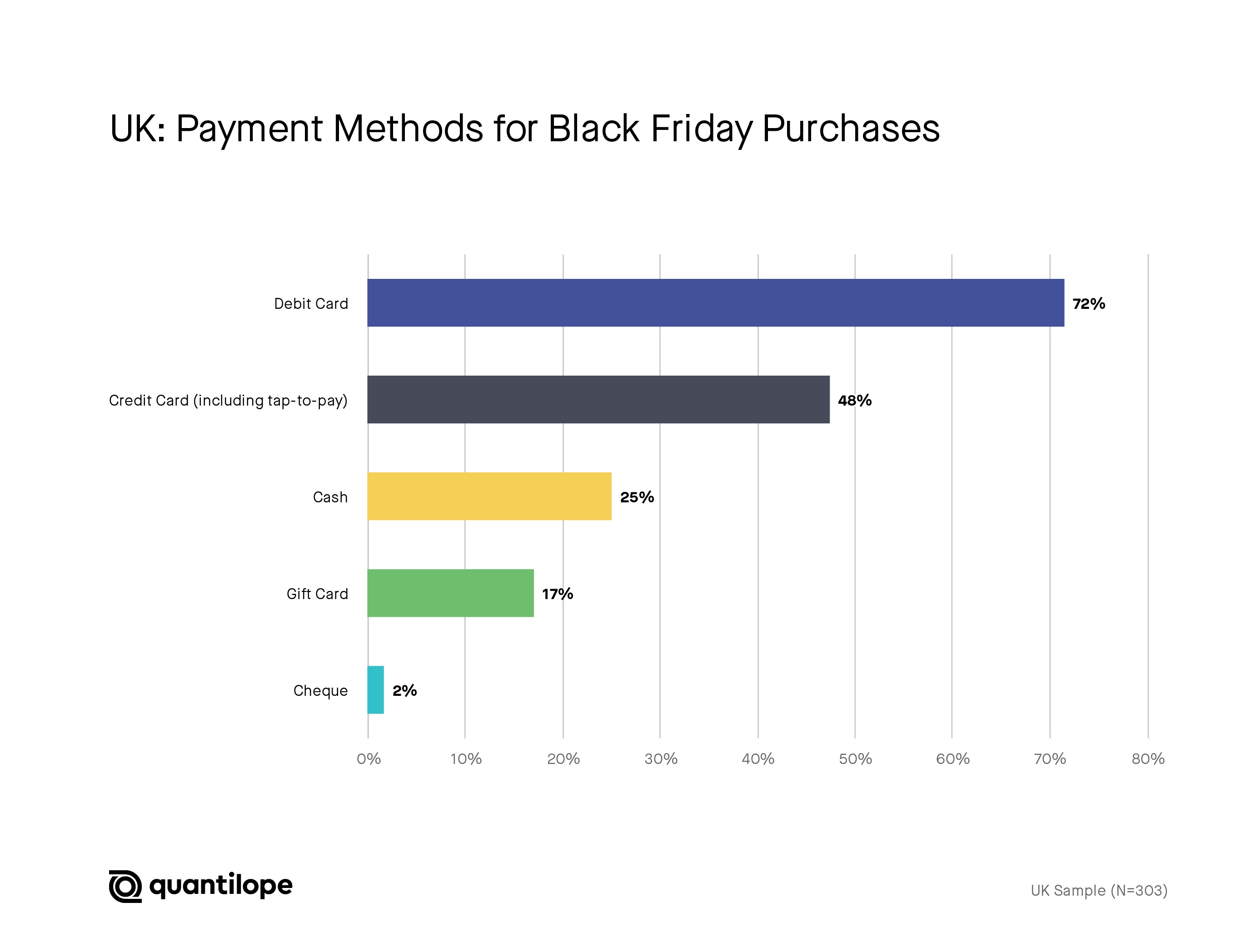

Debit card is the most popular payment choice (72%) among Black Friday shoppers, followed by credit cards (inc. tap to pay) for around half (48%) and surprisingly, cash is the choice for one in four consumers.

Younger shoppers are more likely to use ‘Buy Now, Pay Later’ (BNPL) services according to the study. While around a quarter of UK consumers (26%) plan to use BNPL, this rises among younger generations, with 40% of Gen Z and 36% of millennials planning to do so.

“This is further evidence that the current economic climate impacts what shoppers buy and how they plan to pay for it. But what’s really interesting is that as well as people planning to buy on no interest credit services like BNPL and credit cards, cash is also still a common form of payment,” adds Alex Hall.

This was posted in Bdaily's Members' News section by Amanda Hassall .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning National email for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East