Partner Article

Five Financial Mistakes Business Owners Should Avoid

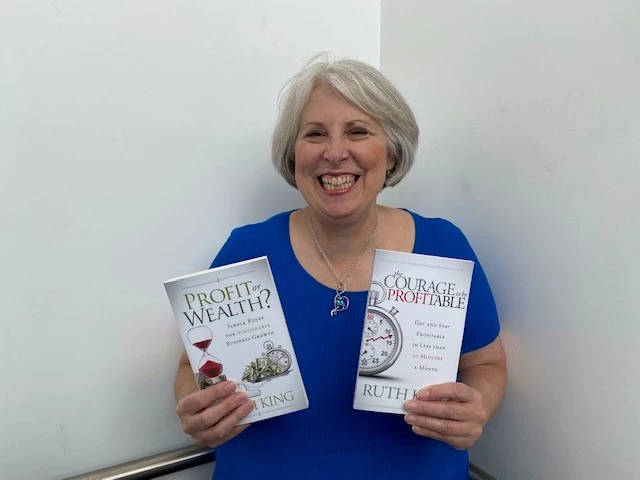

A straight talking Profitability Guru and best-selling author from the US, who has a passion for helping businesses get and stay profitable, having helped businesses across the globe achieve £1,000,000+ profits, is heading to the UK next month, to share her wisdom with entrepreneurs at The Business Show, and prior to her arrival is setting the scene with knowledge sharing golden nuggets from her newly launched book; ‘101 Dumb Financial Mistakes Business Owners Make and How to Avoid Them’.

With almost 40 years of experience behind her and having owned 8 businesses herself, Ruth King, 66 from Atlanta, Georgia says; “If you are like many business owners, the first time you pay attention to the financial side of your company is when you get in trouble. You can’t meet payroll, supplier bills are late, a huge customer leaves, you have a huge tax bill you can’t pay, or another seemingly catastrophic situation occurs. My new book helps prevent these mistakes before it is too late and you are in the middle of a financial crisis and it gives you the tools to prevent business situations that cause you sleepless nights and worry.”

At The Business Show in London (November 22-23, 2023) Ruth will be providing an interactive workshop to give UK business owners the process and tools to build their wealth and achieve their business dreams, having been successful in helping business owners across the globe to increase profits, build wealth, and for some, sell their businesses for millions… Ruth is looking forward to meeting and connecting with more UK businesses and entrepreneurs, after the success of her workshop in Manchester last year, Ruth has been invited to fly back to the UK where she will be speaking on stage alongside; Daniela Tabor, Head of SMB Sales, Northern and Western EMEA, Spotify; Ed Wilson, Brand Partnerships Manager, TikTok; Harmony Murphy, Head of Retail UK, Google; Hanna Saramo, Startup Development Manager, AMAZON; Gurpreet Singh Gill, Business Specialist lead, Starling Bank; Henry Conteh, Service Delivery Manager, Intuit QuickBooks… and many more.

Ruth will be gifting attendees a copy of her latest book ‘101 Dumb Financial Mistakes Business Owners Make and How to Avoid Them’ when they subscribe at The Business Show, she will also be asking attendees: ‘Is Your Business on a Collision Course with a Hidden Cash Flow Crisis?’ - if you visit her stand (B1036), Ruth will answer this question for you, she says; “It take less than 5 minutes to show you whether your business is on a collision course with a hidden cash flow crisis, the answer is shown to you visually on graphs generated using FinanciallyFit. business - this ensures that your business is headed in the right direction and allows you to be able to spot minor issues before they become major crises.”

Ruth has been instrumental in helping businesses grow profitably through; consulting, speaking, training, her books, and Operations Manuals and she is now well-known across the US and beyond as ‘The Profitability Guru’. A serial entrepreneur, one of her businesses, Business Ventures Corporation, began operations in 1981 and through this she coaches, trains, and helps others achieve the business growth and goals they want to achieve. She also spreads her knowledge globally through her many books.

Ruth said: “My goal is to give business owners the processes and tools to get and stay profitable as well as build wealth. I’m excited to meet with UK businesses ideas and share with them ideas that they can implement immediately for a better bottom line and wealth building.

“In both the US and the UK, there are some people who think profit is a “dirty word.” It’s not and it’s necessary to survive and achieve the business goals and life that you want to achieve.”

TOP TIPS - 5 Financial Mistakes Business Owners Should Avoid

- Believing That Profit Is a Bad Word - Many business owners think profit is bad. As a result they don’t price profitably, and then they struggle. They work themselves harder than they would if they were employees of another company. The lack of profit causes cash flow problems, and they experience sleepless nights and stress.Profit is necessary for business survival, even lifestyle businesses, which focus more on cash than profits. Profit must be turned into cash. Cash is necessary to fund payroll and other business expenses. Profit is used to fund growth, increasing salaries, increasing inventory (if you have inventory), and increasing overhead expenses. Without sufficient cash businesses will die.

- Abdicating the Responsibility for the Financial Side of Your Company - I hired a bookkeeper. Now I don’t have to worry about the books anymore.“The first office person an owner hires is usually a bookkeeper. Then they ignore the financial side of the company because they think, It’s being taken care of. You can delegate responsibility for day-to-day bookkeeping activities but you cannot abdicate the responsibility for the financial side of your company. You must retain oversight and review every week and every month. It’s your business. You have to oversee all of it, including financials. Your financial statements are your scorecard. You have to know what they are telling you so you can spot minor issues and take care of them before they become major crises.

- Having Mercedes-Benz Syndrome - This is where business owners want to use their business to pay for their personal lifestyle and instead of investing in the business, they invest in themselves. Don’t get me wrong. There is absolutely nothing wrong with enjoying the fruits of your labour, however, you can’t do it at the expense of your business. You have to save cash for the downturns. You have to save for a rainy day. Having cash does not always mean profits and having cash does not mean that you have to spend it. Make sure that you are earning enough on products to generate reasonable profits and you save some of the money you generate from collections on those sales -this is especially important if you are looking to attract investors.

- Focusing on the Top Line Rather Tan the Bottom Line - Running a successful, sustainable business is not about how much you generate, it’s how much you keep.Volume is vanity. Profits are sanity. The top line is important, but the bottom line is more important. Many small business owners brag about revenue growth, but almost no one brags about profit growth. Track overhead cost per hour and net profit per hour to ensure that your company is profitable as you grow. Calculate these two figures on a yearly basis, and review them every quarter. Shift your focus from growing the top line to growing the bottom line—your net profit.

- Having Financial Statement Fruit Salad - Financial statement fruit salad is when a profit and loss statement reports revenues with no expenses incurred producing the work for revenues, or expenses are reported in a month without the revenues generated by those expenses. If you put revenues in one month and expenses in another month, you are fooling yourself. Here’s what happens: the month with the revenues and no expenses will look like a great month from a profit perspective. You’ll probably be feeling great about the business. The month that has the expenses and no revenues will be a profit loser, and you may feel bad about the business. Neither is accurate. You can’t make good business decisions with inaccurate financial statements.

Ruth’s new book ‘101 Dumb Financial Mistakes Business Owners Make and How to Avoid Them’ is available on Amazon.

This was posted in Bdaily's Members' News section by Chocolate PR .

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East