Partner Article

Banking license approved for banking startup Mondo as neobank space hots up

London-based FinTech firm Mondo has announced that it has been granted its banking license from the Financial Conduct Authority (FCA), which it claims makes it the youngest company to achieve regulatory approval.

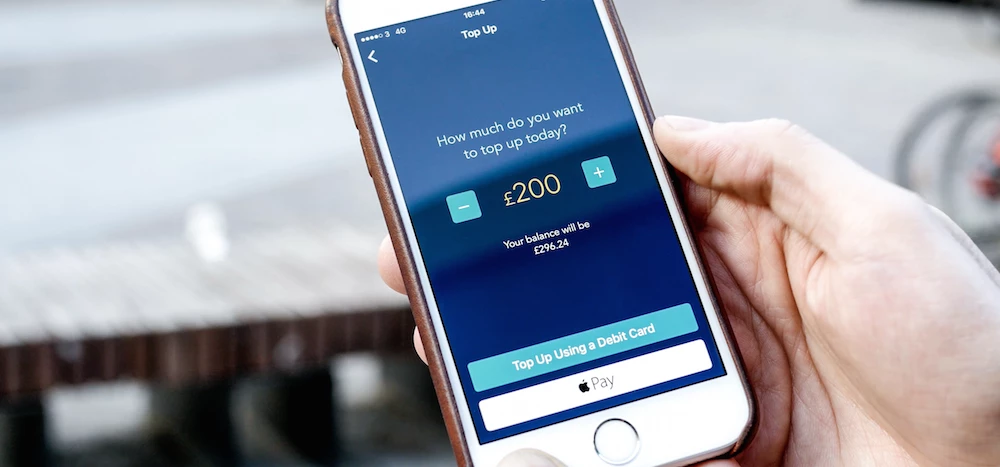

The app-only bank, which has been one of the most well-publicised new generation of challenger banks, has been granted a restricted banking license which will allow it to start holding a limited number of its customers’ money for the first time.

Mondo will also have the opportunity to test out new products and services, again to a limited number of customers, with a full FCA license to follow once regulators are satisfied that the startup meets their stringent criteria.

Its founder and Co-Chief Executive Officer Tom Blomfield has previously commented that the startup will have to raise £15m in order to obtain an unrestricted FCA license ahead of its officially planned launch early next year.

The FinTech startup’s main innovation is its Android and iOS app, which provides users with a range of services and information about their spending, including geolocation features and budgeting advice.

Currently undergoing alpha testing with pre-paid Mastercards, there has been overwhelming demand for the app which managed to crowdfund £1m in just 96 seconds back in March.

The challenger bank joins fellow ‘neobank’ upstarts Atom Bank, Starling and Tandem in becoming a licensed bank and is part of a new generation of smartphone lenders looking to disrupt retail banking with its digital-only model.

Coming off the back of the Competition and Market Authority (CMA) earlier in the week, which recommended a raft of tech-influenced reforms, the UK retail banking sector looks set for a significant shake up in the coming years with challenger banks leading the charge.

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning London email for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East