Partner Article

Goliath Still Winning in Late Payment Epidemic

New analysis from Xero, the global leader in online accounting software, shows that despite continued pledges and policies to reduce late payments for the nation’s small businesses, over half (52%) of invoices were paid late in 2017. The data is drawn from hundreds of thousands of small businesses that process their invoices through Xero.

Launched this week by a panel of experts, including the economist Vicky Pryce, Xero’s Small Business Insights provides one of the UK’s most comprehensive pictures of small business economic health - from the late payment epidemic to the impact it has on cash flow.

This snapshot tracks the performance of small businesses across five key pillars: getting paid, cash flow, hiring people, trading overseas and the adoption of cloud technology.

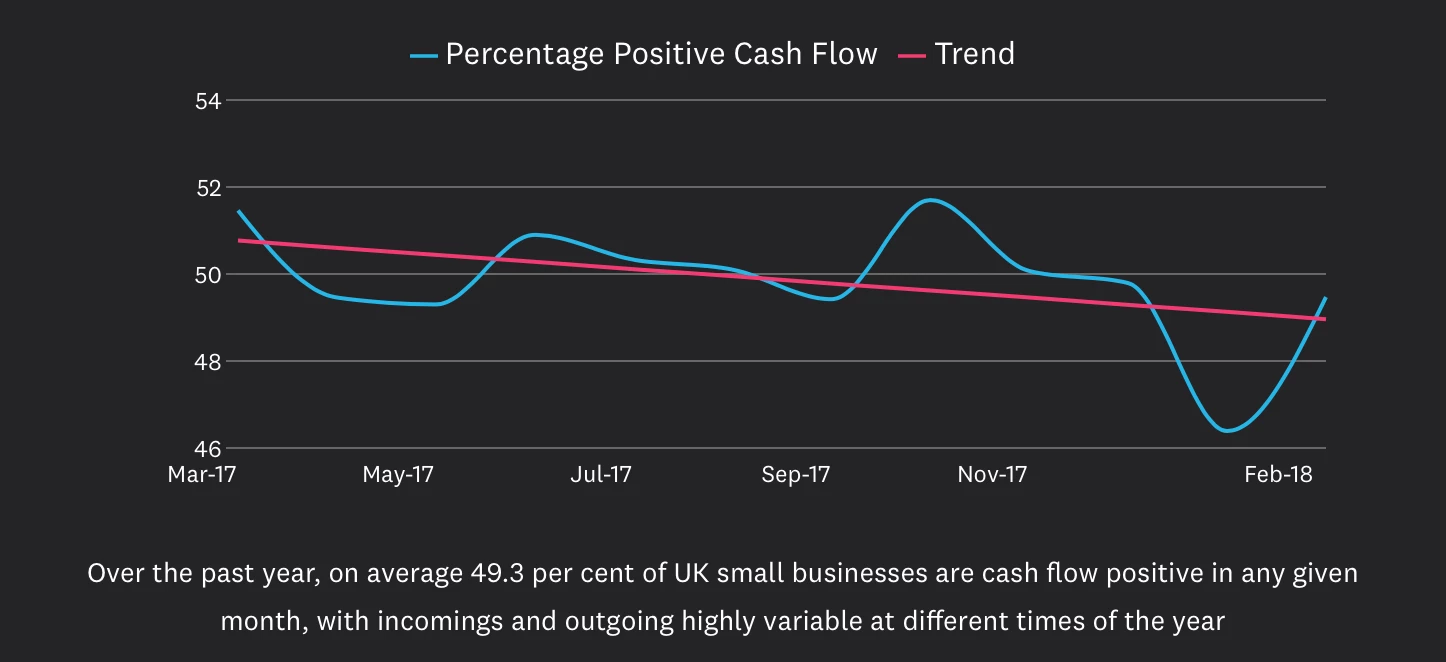

The index reveals that small businesses experience the tightest cash-flow squeeze in the first quarter of the year, with only 45 per cent of Xero subscribers starting the New Year cash flow positive in 2017. Over the past year, cash flow positivity hit highs of 51.7 per cent (October) and 50 per cent (November), dipping to lows of 46.4 per cent in January 2018.

With the Government vowing to eliminate “the continuing scourge of late payments”, experts on the panel warned of the importance of protecting small businesses from the impact on cash flow and the overall economy.

The indicator shows that over the past year 30-day invoices are on average paid after 40 days, nationwide. Yet further analysis of FTSE 350 companies show that on average they pay their invoices after 46 days, a full 6 days longer than smaller firms.

The analysis of the FTSE 350 and their invoice payment times to Xero small businesses subscribers has singled out a ‘watch list’ of consistently late paying sectors. Topping the list were Food Producers (averaging 60 days), Construction and Materials (averaging 57 days), and Household Goods (averaging 53 days).

FTSE 350 companies in the Pharmaceuticals and Biotechnology sector were revealed to pay the most inconsistently, with invoices being paid an average of 47 days in 2017, a low of 37 days in September 2017 and a high of 68 days in June 2017.

Meanwhile, the fastest FTSE 350 sectors to pay were revealed to be Real Estate Investment Trusts (averaging 38 days), Financial Services (averaging 35 days) and the Life Insurance sector (averaging 33 days).

The Small Business Commissioner Paul Uppal commented: “Small businesses are crucial to the health of our economy so it is vital that they feel supported in all areas, but particularly in the fight against late payments. My role as Commissioner exists to help small businesses get paid on time, and while the Government works on measures to address the late payment epidemic, businesses should not be afraid to come to us for help. Now is the time to make Britain the best place for entrepreneurs to flourish.”

Vicky Pryce, economist and previous Director General for Economics at the Department for Business, Innovation and Skills, commented: “The impact of late payments on the economy cannot be exaggerated. Work done by the European Commission looking at both business to business and government to business payments found that late payments were directly associated with worsening firms’ cash flow positions, and particularly for smaller firms. Many are left with no option but to request extensions of overdraft facilities and increases in their financing costs and in bank borrowings. Late payments prevent the economy from reaching its productive potential.”

Other findings include:

Trading overseas Leading up to the Brexit referendum in June 2016, Xero analysis revealed increases in import growth rates, with the year-on-year (YOY) growth rate in April 2016 hitting a high of 30.58 per cent The UK economy as a whole performed better than expected in the six months following the referendum, with August 2016 import growth rates reaching a record high of 62.5 per cent before economic growth started to slow in 2017 SMEs experience positive YOY import growth through 2016 and up until December 2017, with the highest YOY growth rate tracked in May 2017 - up 57 per cent from the previous year - while export growth rate has increased at a steadier pace per month YOY, consistent since May 2016, suggesting small business owners are pushing through economic uncertainty

Hiring The fastest growing industries based on those businesses using our payroll services in 2017 were revealed to be Information, Media and Telecommunications (27.3%), Manufacturing (15.8%) and Health Care and Social Assistance (14.9%) March was 2017’s highest employment growth month at 2.88 per cent - coinciding with March being a relatively high cash flow month - while the worst months for employment growth are October to December

Xero UK’s managing director and co-founder Gary Turner, commented: “Small businesses are the backbone of the British economy however there is little by way of accurate and timely statistical insight into their health and productivity.

“Sharing this data and considering it in the context of the challenges small businesses face will help the small business community gain a deeper understanding of the collective experience. We hope that a greater real-time understanding of the small business economy will help firms, and their suppliers, develop their own economies of scale - helping them close the gap on larger enterprises which traditionally benefit from those economies.

“It will get people talking, creating new ideas and driving for growth – and that is where future success lies.”

The Small Business Insights index relies on every Xero subscriber that meets the criteria for each pillar: getting paid, cash flow, hiring people, trading overseas and the adoption of cloud technology. This makes it more accurate than most private surveys, which have a far smaller sample size. The analysis is updated far more frequently than most small business data pools and will deepen the understanding of the UK’s small business economy providing information that’s more timely and accurate than any other data source.

This was posted in Bdaily's Members' News section by Contributor .

The value of using data like a Premier League club

The value of using data like a Premier League club

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector