Partner Article

Revelock Forms New Advisory Board to Advance Fight Against Online Bank Fraud

Revelock, the pioneer in behavioral biometric based online fraud prevention formerly known as buguroo, today announced the formation of the Revelock Advisory Board, as part of its ongoing mission to reverse the rising tide of online bank fraud.

Comprising some of the industry’s most respected experts in digital identities, threat intelligence, payments technology, fraud and financial crime prevention, the new Advisory Board brings invaluable external perspective to Revelock, gained both in the technology industry and at world-renowned financial institutions. The newly formed Board bolsters Revelock’s ability to proactively protect banks, fintechs and their own customers from the growing volume of ever-more sophisticated online fraud attempts.

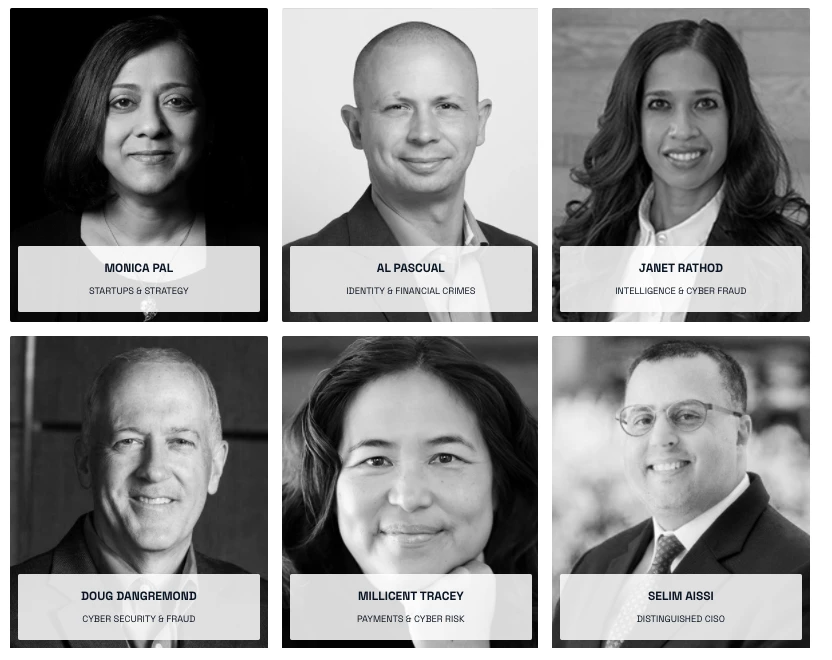

Joining the Revelock Advisory Board as founding members are:

Monica Pal: Pal is a serial entrepreneur and has held co-founder, CEO and CMO roles at cyber intelligence, cyber security, big data and enterprise software start-ups in Silicon Valley. After a decade in Apple R&D, she was instrumental in growing scale-ups such as 4iQ, Aerospike, Alienvault (acquired by AT&T) and enCommerce (acquired by Entrust). Pal is an active diversity and inclusion campaigner, serving on the executive board of How Women Lead and fund advisor to How Women Invest. She takes the position of Revelock Advisory Board Chair.

Selim Aissi: Dr. Aissi is a renowned security expert, a Founding Board Member of the National Technology Security Coalition (NTSC), on the Advisory Board for VC firms and Technology companies, and was named CISO of Year in 2019. He holds over 100 patents and was co-author of the book Security for Mobile Networks and Platforms. He has been the SVP and CISO of Ellie Mae for the past 6 years, where he runs its overall information security program, including operations, engineering, GRC, third-party-risk, and business continuity. Prior to this, Selim was VP of Global Information Security at Visa, where he transformed Visa’s information security practice into becoming the market standard and was responsible for leading company-wide initiatives, including the overall security of Visa Checkout, Apple Pay, and Visa’s Data Protection Program. He has also held senior positions at Intel Corporation, General Dynamics, General Motors, and Applied Dynamics International.

Janet Rathod: Rathod is a cybersecurity leader in the U.S. financial industry, with experience in Perimeter Defense, Cyber Fraud, Anti-Money Laundering, Log Management and Intelligence Analysis. She previously spent 16 years in the FBI, and was a member of the Senior Executive Service. While at the FBI, she governed the intelligence programs for 56 Field Offices. She also oversaw cyber and counterintelligence analysts at the Washington Field Office.

Doug Dangremond: Dangremond brings over 30 years of experience in the technology industry successfully leading diverse teams from sales, marketing and operations within both the public and private sector. He currently serves as Chief Revenue Officer for Constella Intelligence, formerly 4iQ and, prior to that, was SVP of Threat Intelligence for LookingGlass Inc. He has also been President of Cyveillance and has held leadership positions for both F500 companies and startups, including AT&T, Unicom, Neustar, Command Information and Anixter International.

Millicent Tracey: Tracey is a financial services product management executive with 20 years’ experience assisting public fintech companies and startups develop B2B payments strategies. From leading strategic growth initiatives, advising on digital payments transformation and delivering innovative technology solutions, Tracey specializes in understanding financial fraud risks and developing risk mitigation strategies. She also brings invaluable governance experience through her advisory work with corporate and nonprofit boards, including audit and finance committees.

Al Pascual: Pascual is a prominent expert in digital identities, authentication and fraud. Co-founder of Breach Clarity, the data breach intelligence provider acquired by Sontiq, he has also served as Head of Fraud & Security for Javelin Strategy & Research. Pascual has extensive frontline experience of fighting fraudsters, gained during tenures at FIS, Goldman Sachs and HSBC.

“I’m immensely excited to welcome the six founding members to the Revelock Advisory Board,” said Pablo de la Riva, CEO & Founder, Revelock. “Together, they have a wealth of knowledge and experience gathered at leading financial institutions, as well as at some of the most dynamic and innovative companies in the cybersecurity space. Their complementary backgrounds and diverse outlooks will play an instrumental role in furthering our mission to proactively stamp out bank fraud.”

This was posted in Bdaily's Members' News section by Amy Murray .

The value of using data like a Premier League club

The value of using data like a Premier League club

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector