Partner Article

Steps to ensure your business holds up - not folds up - through divorce

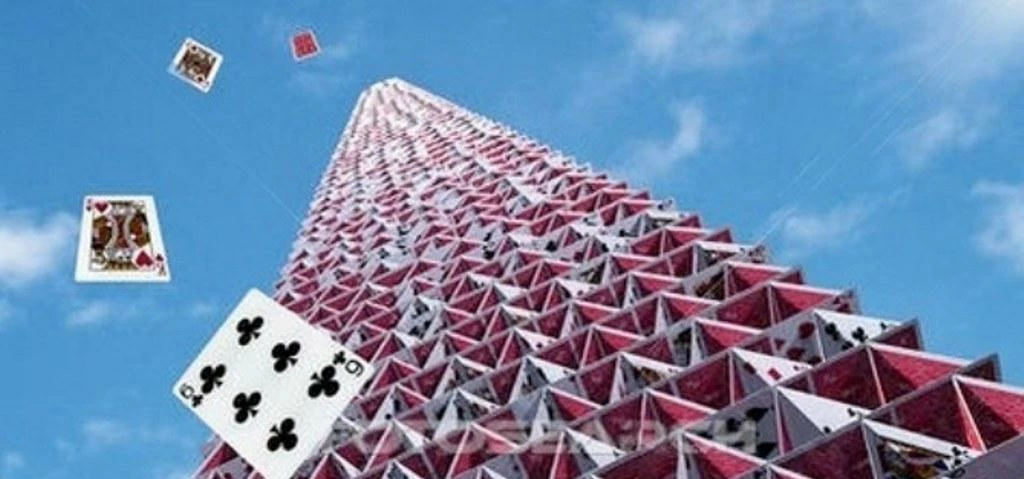

The trauma of divorce, which impacts on separating couples, their children, and their wider family and friends, can be further exacerbated when a business is involved.

Many business owners with failed marriages have found themselves losing an organisation they have worked long and hard to build over decades, to their ex.

With UK family businesses employing over nine million people and accounting for a quarter of the UK’s GDP, according to the most recent statistics from the Institute for Family Business, safeguarding the family company is also critical when a divorce or separation becomes inevitable between husband and wife business partners.

Such cases, when husband and wife teams own joint shareholdings as “co-preneurs”, and are both seeking to retain their stake in the company, are the most difficult to resolve. Many couples also employ their children in the family business - increasing the importance of a smooth transition to safeguard their sons’ and daughters’ respective roles.

In a divorce, a company is regarded as a matrimonial asset, to be sold or shared like any other. It is therefore vital for a couple in business together to secure sound legal advice before marrying, so that a pre-nuptial agreement can be drawn up. If already married, it is worth considering a post-nuptial if you failed to sign a pre-nup - or to protect any new business ventures.

Although pre-nups and post-nups are not legally binding, courts do take them into account and they can make the whole divorce process run more smoothly. However, despite their advantages, they will not prevent your business from coming under close scrutiny. How much is it worth? What income can it produce – now and in the future, when assets are divided? Should it be producing more?

Judges will often examine a business’ liquidity and how this might be paid out to the wider family to meet costs such as accommodation. Although problematic if you planned to use that liquidity as the seed corn for a future start-up, you must not hide any assets.

Collaborative law can be the most constructive, cost-effective and least painful approach to finding a financial solution when both partners are involved in a family business – and can also lessen impact on the company. It sees a couple and their lawyers working together on problems face-to-face, with additional professional advisers such as accountants on hand when necessary. It aims to resolve matters amicably and without the case going to court.

Talking about the future of your business, and who will run it, in a calm and supportive atmosphere is infinitely preferable to the hostility and acrimony of a courtroom battle – and can protect enterprises by avoiding the distress and distraction that can derail a company.

This was posted in Bdaily's Members' News section by Jones Myers LLP .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular Yorkshire & The Humber morning email for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East